Financial Awesomeness

We live in a day and age when majority of people live paycheck to paycheck and are under constant pressure of money issues. According to recent poll by The Canadian Payroll Association, more than half of polled Canadian employees would find it difficult to meet their financial obligations if their paycheques were delayed by a single week. For younger people it’s even higher – 63 per cent of people between ages 18 to 30 report living paycheque to paycheque.

I’ve had my share of financial issues in my life as well. I’ve lived paycheck to paycheck for quite some time. At some point, I had negative amount of money in my name. There’s nothing I liked about this way of living, and I knew I had to move towards something better.

What’s better? Personally, I think you can reach a point when money doesn’t worry you on everyday basis. It doesn’t mean you have all the money in the world and don’t have to work! It simply means that your financial side of life is under control and you are always prepared. I call it “financial awesomeness”.

Being financially awesome also means you’re no longer under great stress of living paycheck to paycheck. You can afford to spend more time with your family. May be working four days a week instead of five simply because you no longer need every single dollar from your paycheck? Enjoying extra trip overseas here and there? All these things sound appealing to both me and my wife, and we’re doing everything we can to move towards it.

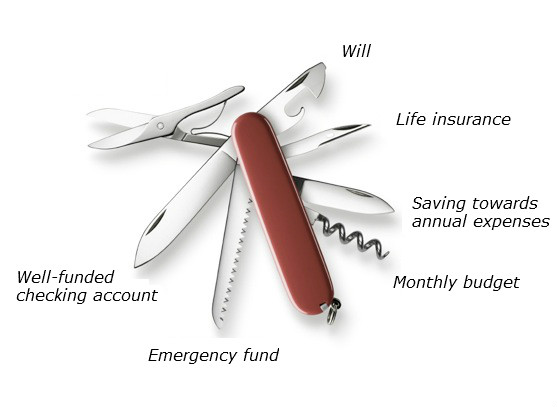

Here are few steps I think will get us (and anybody else for that matter) to financial awesomeness:

Financial Awesomeness