Whatever happened to our solar energy investment?

Back in May, I’ve mentioned how we’ve decided to invest directly into solar energy production in Ontario by investing into Solar Income Fund. This great company specializes in developing, acquiring, and management of solar farms. Some of them are simple rooftop operations, and some are major solar energy farms taking up acres of land.

Solar Energy Investment

Great thing about solar energy investment in Ontario is the fact Ontario government guarantees to pay top dollars for electricity generated with these farms. While developing and construction phase might be capital-intensive, generating income after that is easy and virtually maintenance-free.

Unfortunately, our investment has been delayed with a major change in SIF management team that had to be reviewed before proceeding. Management can make or break company, so any changes to the management team have to be disclosed to investors.

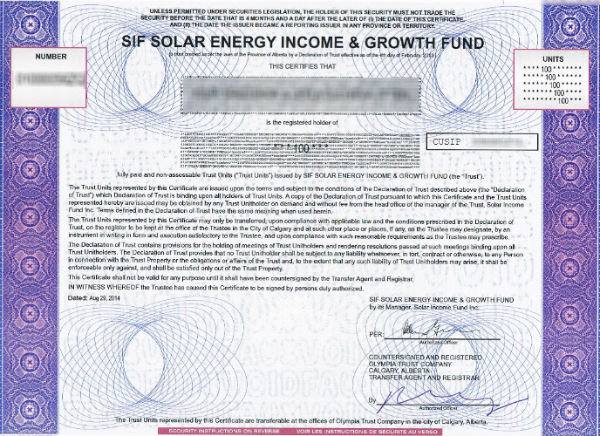

But I’m happy to say that we’ve still decided to proceed and put $10,000 towards our solar energy investment! And here’s the proof:

Solar Energy Investment

Other options I’ve considered

Of course, being a huge financial nerd I’ve considered other options for these funds.

Spending $10,000 on nice things.

Following Kapitalust‘s awesome take on building vs. spending wealth, I’ve thought of iPhones as an alternative to our investment. We could have bought 10 new iPhones with $10,000 and be the coolest kids on the block. Unfortunately, this option comes with a negative return on investment as nice things (no matter how nice they are) tend to drop in value over time. The new iPhone might be worth $1,000 right now, but in 12 months it will only be worth $500 tops. What does it mean? The return on this “investment” is -50%. What a great way to lose your money fast.

We also could have bought a brand new car. Our car is quite aged by now, and the new car smell is a thing of beauty. Unfortunately, new cars lose value faster than the smell goes away. Once you buy a brand new vehicle, you automatically lose 11% of your money with 15% to follow for every year thereafter. Also a great way to lose your money fast.

Keeping $10,000 in our savings account.

Unlike previous options, this is a slow way of losing money. While 1.3% return on investment is greater than zero, it still below our current national inflation rate of 2%. On any given year you will earn 1.3% on your money, but the value of these funds will lose roughly 2% of buying power. Yet another losing proposition!

Putting $10,000 towards our outstanding mortgage.

This option actually makes sense from financial point of view. By reducing our mortgage, we technically avoid paying interest on this amount thus saving us a considerable amount of money. In this case, the return on investment is equal to our mortgage rate (3.89%).

Certainly not bad. Especially given the fact that this return on investment is guaranteed.

How does solar energy investment stack up against these options?

Solar energy investment on the other hand comes with 9 percent return distributed monthly with some upside potential (additional profits distribution) split between investors and the management team pushing the overall return on investment even higher.

Yes, the risk is there. Unlike repaying our mortgage which carries no risk, our solar energy investment can be considered risky. What if the management team runs the company into the ground? What if they’re unable to acquire solar energy farms? What if competition is just too strong?

After reviewing their past performance, I have nothing but confidence in this company. They have vast experience in this field, and been delivering outstanding return on investors’ money for years. Also, I’m quite happy with taking some risk because I understand that no investment worthy of making is risk-free. We’re still very young, and we need to take risks in order to grow our net worth if we ever hope to achieve financial independence.

Our solar energy investment is already making money!

Once we’ve put the money towards our solar energy investment, it started producing returns for us right away. Just recently I noticed our first dividend was deposited directly into our bank account:

Solar Energy Investment

Seventy five dollars is exactly 1/12 of a promised 9% dividend. This money will be hitting our account month after month. We don’t have to work for it, we don’t have to be even awake. The passive income generated by our solar energy investment will keep flowing. Isn’t investing great?

What’s next?

We’ll keep collecting dividends on this investment month after month. Instead of spending it, we’ll be putting this money towards other investments to keep money growing. Once this investment exits (which is planned in 3 to 5 years) and the principal with added profits is paid back to us, we’ll be looking for another investment.

Wash, rinse, repeat. I mean, invest the money, earn return on your investment, and re-invest it again. I hope with enough repetition to get to the point when money we have will work harder for us than we have to work for our money!

And I’m still hoping to visit one of the solar farms in person!