What are podcasts?

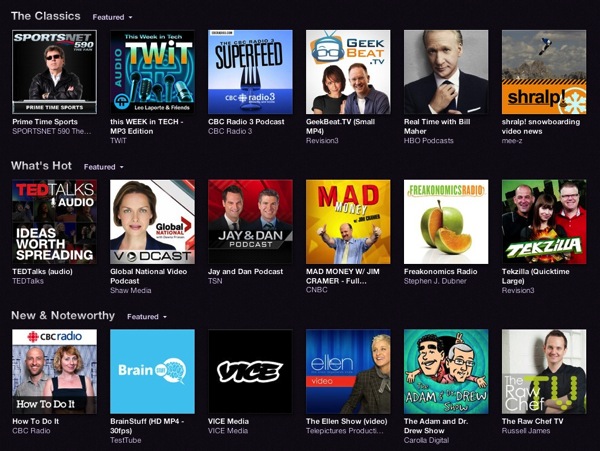

Well, before I talk about best personal finance podcasts, let me explain to you what podcasts are. Podcasts are digital radio and video shows that are available on your mobile devices completely free of charge. Unlike radio stations, they’re recorded offline, and uploaded for everyone’s enjoyment. Most mobile devices (iPhone/iPad, Blackberry, Android phones, etc.) have an app that allows you to search, subscribe, and listen to a podcast of your choosing. Think about them like your favorite TV show - once a new episode of Top Gear comes out (which happens to be one of my favorite shows), your iPhone downloads that new episode automatically and signals you it’s ready for your enjoyment. You can even listen to them on your laptop or PC, but I prefer a mobile device.

best personal finance podcasts

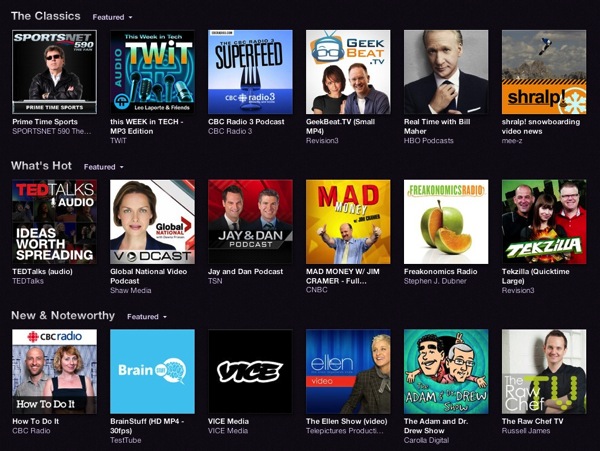

There is a mind boggling number of podcasts out there on different topics. Comedy, philosophy, business, education, etc. Basically, pick a topic, and there’s probably a podcast about it - even if it’s raising bunnies for food in captivity:) Most of them are audio-only, but there are some video podcasts as well. Just hit “Podcasts” app on your mobile device, and you’ll see thousands of them ready to be downloaded. My data plan on my phone is pretty pricey, so I always download all of my podcasts over WiFi. There are settings to manage that aspect on both Blackberry and iPhone.

Personally, I love podcasts. For some reason, it’s easier for me to listen to things as opposed to reading - that includes podcasts, talking to people on the phone, or listening to audio books. For that reason, podcasts are ideal for me. Listening to some of them became almost a ritual to me and a very good habit. Just one of the things I do to keep myself educated.

Why are podcasts so awesome?

First of them, they’re free. Second, they’re educational in nature. Third, they let you transform the time you’re wasting into time well-wasted. For example, one of my habits is washing the dishes and tidying up our living room at the end of the day. It’s almost like a ritual for me before winding down for the day. Instead of simply washing dishes, I listen to a podcast AND wash dishes. Keeps me from getting bored - and also keeps my wife happy as she hasn’t touched the dishes in years.

I also spend considerable time driving sometimes - nothing like having 3-4 hours of entertainment and education saved up for a long trip.

Best Personal Finance Podcasts

Following are some of my favorite podcasts on the subject of personal finance. Hosts of these podcasts are very educated individuals, podcasts are very educational in nature, and bring a lot of value to listeners. Best of all, they’re all free. Some of them have commercial spots, but they’re easy to ignore.

Motley Fool Money is a great resource on investing. They cover major events in investing world, economy, and business news. Their weekly podcast comes out on Friday, and covers major events that took place that week. They also have an interview or two on different subjects, and some rather entertaining banter. After listening for a while, you start to understand how some of the publicly traded companies perform, learn to make educated guess about investments, and simply stay “in” on business news. Highly recommend!

They also publish Market Foolery podcast - this is a daily podcast about stock market events. If something major is happening on the stock market, they’re probably discussing it in these very short (10-15 minutes) daily podcasts.

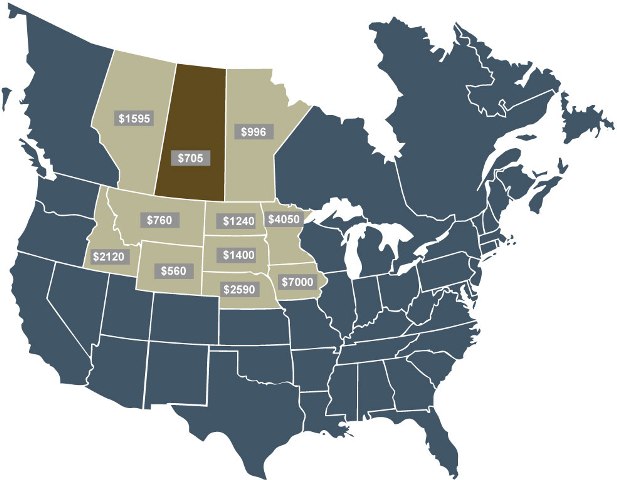

Brian Preston runs a wealth management company somewhere in the south of US. Every other Friday, they put together a podcast about personal finance and investing. Unlike Motley Fool described above, they mostly cover topics of personal finance and investing from the point of view of average people. They put together podcasts full of useful information. Though their personal finance philosophy is a bit different from mine, I listen to these guys religiously. My only grumble about them - being from US, a lot of their information on taxes and investing is very US specific. But general advice and tips and tricks are absolutely fantastic. I consider it to be one of the best personal finance podcasts out there.

Dave Ramsey is an award-winning author of several books and a host of Dave Ramsey radio show with an enormous and cult-like following. Though not very known in Canada, his books are absolutely fantastic for somebody who is stuck when it comes to personal finance. Motivational value of his books alone is out of this world. His philosophy on money and personal finance is very old-fashioned, and very simple - yet very effective. His daily podcasts are about 40 minute long recordings of his daily radio show and features callers with specific questions and Dave’s advice on how to solve their money problems. Sometimes some of his rantings too!

He can be a bit controversial for some people, but overall it’s a great podcast to listen to keep yourself motivated while fighting through money problems. Nothing like listening to people scream “I’m debt free!!!” to keep yourself going!

Here’s what I love about Stacking Benjamins podcast. Two fellas by the name of Joe and OG mastered the perfect balance between a serious show that talks about personal finance and entertainment. A lot of personal finance podcasts tend to be overly dry. Stacking Benjamins on the other hand makes the process of learning about money fun and entertaining.

I love the fact they go outside of the normal financial advice and talk about alternative investing and matters related to personal finance such as career development and education. They don’t try to sell you on services or products, and offer genuinely great personal finance advice.

If you want to pick just one personal finance podcast to listen to, I would absolutely pick Stacking Benjamins. You won’t be disappointed.

Money Plan SOS is a podcast of Steve Steward, who is a personal finance coach. His weekly podcasts are more about an average person fighting for his money. He doesn’t touch much on business in general, more on things about how you personally can improve your personal finance well-being. While he closely follows Dave Ramsey’s teachings (being one of his approved coaches), Steve injects a lot of his personal thoughts into his teachings that make this podcast very valuable. Unlike other financial coaches, he shares his mistakes and struggling as well as successes - and it tends to be very personal.

Why haven’t I discovered this podcast before? I’ve recently discovered this podcast and just had to add it to my list of best personal finance podcasts. It would make my life so much easier! In all honesty, it took way too much energy and time for me and my wife to work out the best way to deal with money as a family. Heck, I didn’t even know how to talk about money at the beginning. Many days were lost to heated discussions on how to spend money and how we can improve our financial situation. Thankfully, we were able to work out all the kinks without cutlery flying across our house, but there were a few close calls.

Derek and Carrie run a podcast with focus on how people relate to money in their marriages. They discuss topics of talking about money with your spouse, creating budgets, pros and cons of combining finances, and many other topics. If only I knew about this podcast sooner! If you want to improve your marriage and communicate better with your spouse on money topics, this podcast will be invaluable to you.

Sometimes one can find the process of learning a bit tough if they can’t relate with the person presenting the information. For example, I’m a younger person (ok, younger’ish), and I can’t listen to a boring university lecture about compounding interest or mutual funds. In most cases, I’d like to learn from people just like me, who have same challenges, fears, and inspirations.

Well, Listen Money Matters podcast is right up my alley. Matt and Andrew speak about personal finance without holding anything back. They’re not university professors teaching economics, they’re your average everyday dudes who just happen to discuss personal finance and investing world. They speak my language and I can relate to them on many levels. Heck, they even discuss drinks they’re consuming at the moment!

If you’re looking for people you can relate with and learn some valuable lessons about money and investing, give Matt and Andrew’s podcast a try!

How do I start listening to podcasts?

best personal finance podcasts

Just hit Podcasts app on your iPhone or Blackberry. At this point, the app will let you browse the entire library of podcasts, or search for specific ones. I highly recommend you to check out these specific shows as I consider them the best personal finance podcasts. Hey, you have nothing to lose - all of them are free. Think of your car as a university on wheels - instead of just driving to work, might as well drive to work and educate yourself. Or wash dishes - whatever is it you’re doing can be used as a chance to educate yourself on personal finance.

I love the fact they go outside of the normal financial advice and talk about alternative investing and matters related to personal finance such as career development and education. They don’t try to sell you on services or products, and offer genuinely great personal finance advice.