I want to be all about passive investment income!

One thing I’m always curious about is how people live. A bit nosey, but it became a habit shortly after moving to Canada from Russia as I tried to become more social and more familiar with Canadian people.

After looking at how people around me live, I’ve come to conclusion that there are two types of people. One group of people (group A) goes to work every day and works to get a paycheck every two weeks: store employees, nurses, police officers, business managers, truck drivers, and many others.

And group B lives off passive investment income without going to work. They enjoy income earned in forms of dividends, business distributions, royalties, and even blogging. Of course, there are people who happily enjoy both of these worlds and use passive investment income to increase their earning capacity.

Passive Investment Income

Personally, I’d like to see us slowly transition from Group A into Group B. And I been thinking about this for quite some time and discussed possibilities with my wife.

What would this transition look like? Well, currently we’re making decent income for our age group. Money we earn comes in every other week and leaves in form of bills and expenses. What if we could replace work income with passive investment income, and pay our bills and expenses with it? That would put us into strange world where we can choose to work, but are not forced to do so. We can spend more time enjoying doing things we are passionate about. We can probably do more travelling and connect better with our family members living overseas. Oh boy, do I like the sound of that!

Work income has huge downsides:

- It requires work! Sometimes very hard work. Sometimes it requires hard physical labour. When I first came to Canada, my first jobs were pure physical labour with very little thinking involved. After few days of it, I’ve discovered I’m not a big fan of it.

- Work takes away your time. Now, no matter how much you enjoy your work, it still takes time commuting back and forth. Sometimes it requires a fair amount of travelling and thus time away from your family. And no matter how much you like your job, there’s always paperwork that comes with it, and nobody likes paperwork.

- Work requires being someone else’s employee. While I don’t really have a problem with this concept, I think we can all agree that at times it sucks big time.

- I’m going to go ahead and ask you to come in on Saturdays, yeahhhh

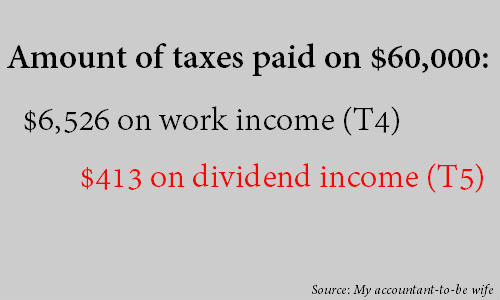

- Work income is taxed much higher than any other income. Since our government wants to encourage investing money back into economy as opposed to just spending it, payroll taxes are much higher than investment income taxes. So, if you receive $60,000/year from work, you will pay much higher taxes comparing to the amount you’d have to pay if you received $60,000/year in form of dividends (which is a form of passive investment income).

Why Passive Investment Income rocks!

At the same time, I don’t want to completely dismiss work as something negative. Work can be great fun. I can see how work can provide structure to my life and great meaning if I work in the industry or company I feel passionate about. What will happen if this no longer available? Big question mark.

Personally, I’m thinking doing volunteer work would do the trick or even working part time. I’m the kind of guy who always wants something going on in his life, and complete lack of work will probably cripple me. Don’t want to become one of those people who sit home all day and watch TV just because they have nothing going on in their lives.

Passive Investment Income benefits:

- It doesn’t require work! Once you’ve done your due diligence and completed necessary paperwork, your money goes to work right away. Other people have to get up in the morning and commute to work to make sure you receive your monthly checks in the mail.

- You can make money while you’re sleeping. Or messing around your yard. Or playing with your kids. You money works harder for you than you can ever work - and you can literally be napping while your money is producing income.

- You don’t have to worry about going to work and paying bills while going on an epic motorcycle journey from Alaska to South America:

But just like work, passive investment income isn’t so black and white.

For example, work income carries no risk. If you lose your job you can dust off your resume, talk to few people, and get yourself another one in the matter of days thus replacing the income stream. But if you’ve invested a significant amount of money into a business venture in hopes of producing passive cash flow but you lose your money? This can set you back in a major way since now you have to replenish your investment capital.

Sources of passive investment income:

After I’ve discovered how much I like passive investment income, I’ve started looking around to see which of them would interest me. Some of them I’ve dismissed right away because I don’t see myself ever writing a new Billboard hit song and enjoying endless royalties for years to come. Others looked appealing enough to explore them!

Dividend-paying stocks

This by far is my favourite possible way of creating passive investment income. If picked right, you can create income for years to come. Of course, it requires a great deal of due-diligence to make sure the company you’re buying is able to deliver what they’re promising and sustainable enough to keep paying dividends year after year (or even increase it).

Just about anybody can open a brokerage account and buy dividend paying companies. You want to buy quality companies with good metrics, and a good professional investment advisor can help you with that. There’s also a great deal of information available on-line.

Why Passive Investment Income rocks!

On a side note, our Solar Income Fund investment (have you seen the update for it?) is already producing passive investment income for us. The investment pays 9% annual dividend deposited monthly straight into our checking account without any input from us. Mind you, the amount produced isn’t anywhere close to what we’d need to replace our work income at the moment, but it’s a start, right?

Stock photography

I’ve mentioned before my interest in photography. For a few years, photography was my very expensive hobby that actually produced income once in a while. I’ve shot a number of weddings, few corporate events, artist portfolios, you name it! Once, I was even hired to be a paparazzo to take shots of a celebrity on vacation. But my favourite part of being a photographer was ability to sell my shots to stock photography companies and earn a commission from my photos.

Stock photography companies are in business of acquiring photos from professional photographers and selling them to publishing companies. For example, advertising companies buy stock photos to appear in print or online advertising. Every time one of my photos is downloaded by a client, I receive a small commission deposited into my account. The amount isn’t impressive (usually between $0.50 and $5.00 depending on payout structure), but if you have few thousand pictures uploaded, it quickly adds up.

Great thing about stock photography income is complete lack of my involvement. I’ve uploaded few hundred of my pictures years ago but the pictures still produce income and money still flows to me (currently it’s around $100/month). If I want, I can go out and take more pictures to add to my portfolio hoping to increase the income.

Although I never see us living off stock photography commissions, it’s a good example of creating passive income within the reach of anybody who can operate a camera.

Rental Income

Rental income sounded appealing to me at first. Sounds fairly easy - you buy an investment property, get some tenants, and collect their rent checks month after month while slowly repaying the mortgage and keeping up with property maintenance. If bought properly, return on investment can be quite lucrative!

Unfortunately, I’ve heard too many horror stories from landlords and witnessed them myself when called in for repairs. I’ve seen midnight moves when renters would literally leave everything behind and move out of the province. I’ve seen student renters who would absolutely destroy the property before leaving. This would include unplugged refrigerators full of spoiled food, huge holes in drywall around the property, giant parties that went really really wrong, etc. Damages would be way above and beyond what standard damage deposit would cover, and landlords would literally cry when faced with that.

Why Passive Investment Income rocks!

I absolutely understand the importance of background checks to minimize such occurrences, but I still find it intimidating. I admire anybody who was able to build a profitable rental business. Perhaps in few years I`ll come back to this and ponder it a bit more.

Edited: Also, my wife says I’m too nice to be a landlord. Whatever that means.

Business Income

Business income can be produced if you invest a substantial amount of money into a new business (manufacturing, restaurant, home service, self-storage, etc.) and take a passive role in it. You can still participate in day-to-day activities on a limited scale, but the management team in place will run it, and hopefully you will see a profit stream from it. You basically become a silent partner - you bring the money and expertise, and other people bring management experience and run it for you.

Once again, sounds very appealing. But unlike buying a company with a history of profitable operations like dividend-paying companies I’ve mentioned earlier, becoming a silent partner in a brand new business comes with huge risk. Unless you’re 100% sure in management abilities and have enough expertise in that particular industry, you might not be able to sleep well at night. At the same time, returns on your investment can be above and beyond anything you see on stock market.

Personally, I don’t feel I have enough business expertise in any particular industry to be confident enough to give somebody huge chunk of our money to start a business. Buying into an existing business is possible, but you have to know people who are looking for capital and would be willing to sell a share of their profitable company.

So, for now I won’t consider this way of creating passive investment income, although it’s one of my goals in life and I will be coming back to it later on.