What is mortgage investment corporation (MIC)?

Lately, mortgage investment corporations have been getting an increasing amount of media attention. Yet if you’re interested in investing in general, there’s very little information out there on what mortgage investment corporation (MIC) is and how one can benefit from them. I’ll try to explain it to the best of my abilities and even share my personal experience with one.

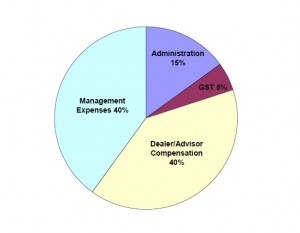

MICs are investment vehicles that focus primarily on mortgages. Thousands of investors pool their money together. Then a newly formed MIC starts lending out the funds to qualified borrowers. MICs are professionally managed by a management team that is compensated with management fees and incentified with a partial cut into profits.

Mortgage Investment Corporation

In reality, mortgage investment corporations are just like banks. Banks borrow money from depositors and lend money out to borrowers. The difference between the amounts of money they make from lending and interest they pay to depositors is their profit.

Somewhat similarly, mortgage investment corporations raise their capital from investors, lend the money out, and funnel the profits back to investors. Some of them choose to also borrow money from banks at low interest rates - but not all of them.

There are many MICs currently on the market, some private and some public. The amount of money flowing into them from investors attracted by very reasonable yield is always exceeding previous years numbers. Largest players in this market include Firm Capital, MCAN Mortgage Corp., Timbercreek Senior MIC and Trez Capital MIC.

While the amount of capital under management and lending guidelines vary from company to company, the general business model behind generating income is very similar between them.

Why I’ve decided to invest my money into MIC:

I’ve stumbled into MICs almost by accident. At the moment, I wanted to park some of our money in a investment with good returns, but at the same time somewhat liquid - meaning we’d be able to get the money out even if it meant paying a penalty.

High interest saving accounts offered by major banks do not offer meaningful returns these days - you’ll be lucky to get anything over 2%. On the other hand, putting money into an index or mutual fund (even with stable history of returns) didn’t seem appropriate for this money. Hey, I like mutual and index funds just like any other guy, but we all know they can go up and down rather wildly.

Investment

Through our financial advisor, we’ve found Crossroads DMD - a Calgary based mortgage investment corporation. They’ve been in business for a number of years, and pride themselves on delivering outstanding returns to their investors while operating a portfolio of many millions under management. This includes first and second mortgages, bridge financing, and construction loans.

Unlike conventional mortgages, these types of mortgages come with higher interest rates. While some people might say it’s because the risk is greater (and honestly, I tend to agree with them to some degree), one must understand this area of financing is very under-served and thus the amount of capital available is limited. Big banks that come with big capital prefer to deal with conventional mortgages, so smaller companies like Crossroads DMD are able to capitalize on small and medium-sized loans in this specialty market and command higher interest rates because of it.

When they lend out investors money, borrowers put their properties on the line. This means these mortgages are secured by real hard assets thus minimizing the risk to investors. They won’t lend out more than 85% of the asset value - which means even if the borrower goes belly up, the investment corporation will be able to recover the funds.

Over the last several years, Crossroads DMD delivered on average over 10% to their investors in form of dividends. Since inception, the average rate of return is 10.6% per annum.

This particular investment also features hurdle rate - a specific target for return on investment that must be reached before the profits are distributed to shareholders. Investors get paid first! Investors also get a 10% share of the profits above the hurdle rate thus benefiting from great performance of the management team. What a great incentive for the management to deliver good returns.

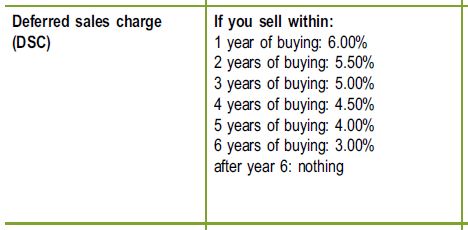

While the investment is liquid and money can be returned to you upon request, an early exit fee (sometimes called “retraction fee”) will apply if money is withdrawn before 3 year mark.

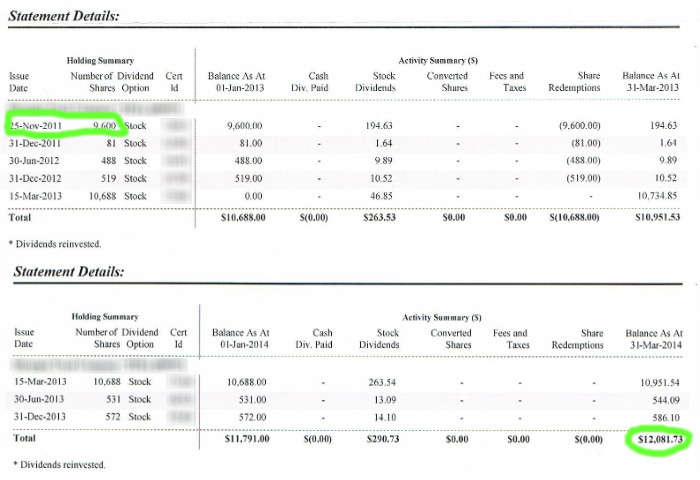

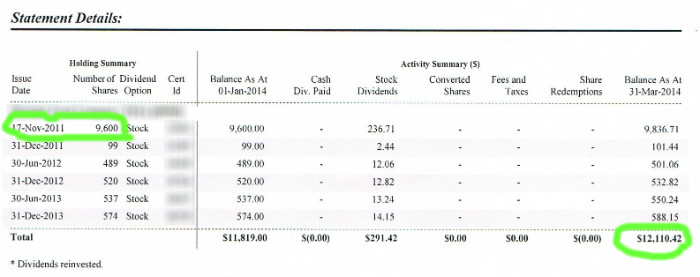

Here’s a snapshot of our investment:

Amount invested (Nov. 17, 2011): $19,200 split between two TFSA accounts.

Investment balance (Mar. 31, 2014): 24,192.15

Mortgage Investment Corporation

Mortgage Investment Corporation

Return on investment: 10.44%

Personally, I’m quite happy with this investment. While some index funds showed outstanding gains over the same period of time, I feel like this is a more stable investment for me. The returns are stable even through tough times! The management team does a great job taking care of investors’ money, and the dividends keep dripping steadily into account. Also, while I might have to pay an exit fee, I have the access to these funds at any time.

All in all, good place to park the money for 3 to 5 years with fairly predictable outcome.

Mortgage Investment Corporation is not for you if:

- You are not comfortable with taking risk

Let’s be honest, the great market crash of 2007 is still not that far behind us. Lots and lots of real estate investments went belly up or taken a serious hit, so some people might not be comfortable with the idea of investing into a mortgage company. I know my first reaction was like that! But after reviewing company’s strict lending rules and their historical returns on investors’ money, it became clear to me that the management in charge of investors’ money is absolutely top notch.

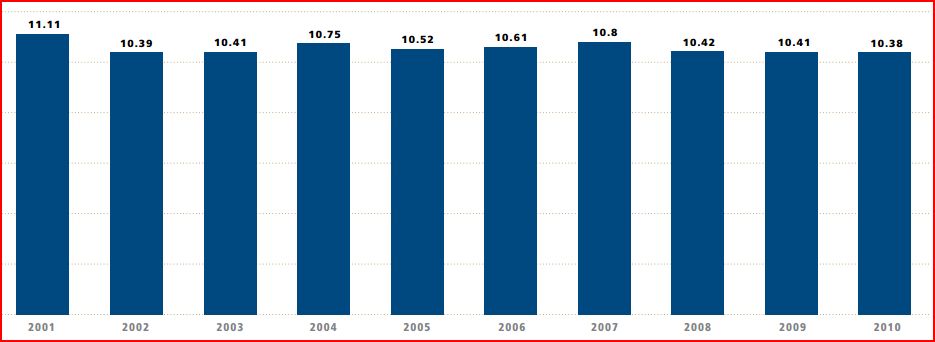

Here’s a snapshot of returns investors received over 10 years:

Mortgage Investment Corporation

Notice how returns have not changed much during our last real estate crash? Yes, the returns went down by 0.4% but never dipped below their hurdle rate of 10 percent. This means their lending practices are very conservative, and their performance doesn’t correlate with real estate market performance in general.

But I’m not going to sit here and tell you this investment is completely safe. The risk is always there, and you have to be comfortable with risk. This is not a magic investment that combines higher than average returns and low risk! Mortgage investment corporations can and do go out of business, so approach this type of investing with caution. Do you homework, read the memorandums, and do research on past performance and current management team.

Check out this awesome checklist for picking MIC to see what you should be paying attention to while considering your options.

- You’re looking for an “exciting” investment.

Putting your money into a mortgage investment corporation is not very exciting. There are no stratospheric returns to brag about. Mortgage investment corporations are not widely mentioned on the news like latest Facebook IPO. You simply put your money in, and it starts dripping dividends into your account in a form of cash distribution or reinvestments. You won’t hear from them unless you receive a statement with your earnings. And if you’re trying to impress your friends with this investment at the next cocktail party, most likely you will put them to sleep explaining what they do.

Some investment can be exciting. For example, one of our investments in solar energy is truly exciting to me because of the difference it will make in Ontario. Green! Solar! Energy! Sounds pretty cool, eh? Mortgage investment corporation on the other hand is a very predictable and boring investment that simply drips dividends into your account. Yawn.