Best Savings Account -President’s Choice Financial or Tangerine?

hello, friend!

Thank you for visiting this page! Make sure to scroll down all the way to the bottom to find out how you can earn free money just with a few keystrokes!

When it comes to savings accounts, in my view there are only two valid options today. It’s either President’s Choice Financial or Tangerine (or Bank Formerly Known As ING DIRECT). I would never consider opening a savings account at any other bank simply because none of other banks offer completely free savings account with all features included without fees of any kind. These two are your best options because:

- Both savings accounts are completely free (no min. balances, no monthly fees)

- They both offer competitive rates on your savings

- Both come with an array of features one would find useful

- You can open yours in a matter of minutes. Like, right now.

None of the other banks made the cut simply because none of the other banks managed to offer the same value. Some banks offer free savings accounts only if you already have a checking account with this bank. Others offer bare-bone accounts with limited accessibility and no features. Some banks demand a min. balance in your account for it to be free. So, for the purpose of finding out which bank offers best savings account I won’t even consider them.

So, who offers the best savings account? Let the battle begin!

Round 1: Rates Offered

Best Savings Account - Tie

Currently, both Tangerine and President’s Choice Financial offer similar rates. Today, you can get 1.30% on your savings with 2.50% promo on new deposits at both financial institutions. Historically though, Tangerine (formerly known as ING Direct) always offered slightly better rates. It was 5.00% just few years ago, but now we live in low interest rates era, so it came down significantly.

This is a solid tie, at least at the moment.

Round 2: Services Included

- In my opinion, Tangerine actually promotes saving money as opposed to just offering it as a service like PC Financial does. Even their old TV ads were all about “SAVE YOUR MONEY!” Are you thinking of saving towards a specific goal such as vehicle, house down payment, or a flight into space to experience zero gravity? Well, Tangerine offers a calculator that will break down how much you have to save every month to reach your goal, and will set up an automatic saving program that will transfer this amount from your account. With President’s Choice you are on your own, though regular transfer option is available.

- In both cases, you can access your monthly statements online. However, with President’s Choice account, I can only go back 13 months. With Tangerine, I can go back as far as 7 years. While it’s not super important, it might come in handy if you’re looking for a specific transaction that happened years and years ago - say, if you’re getting audited by CRA/IRS.

- Tax forms are readily available on Tangerine’s web site. President’s Choice Financial either doesn’t let you see them or hides them very well in one of their confusing menus. I just tried to find them and failed miserably.

Round 3: Online Access

Best Savings Account - Tangerine Wins!

Tangerine wins hands down in this category.

- Tangerine web site is much easier to use. They’ve put a lot of work into their design, and it shows. I’ve never felt lost when doing my online banking with Tangerine.

- With Tangerine, you can deposit cheques into your account without leaving your home. All you have to do is to install their app on your smart phone, take a picture of your cheque, and money gets transferred into your account. How easy is this? President’s Choice Financial doesn’t have the same feature, but I anticipate its arrival any day though - simply because their parent company (CIBC) is already using this technology. But for now, if you want to make a deposit into your PC account, you have to go to an ATM.

- Speaking of smartphone apps. Online banking app offered by Tangerine has more features than President’s Choice Financial. For somebody who basically lives online (just like anyone under the age of 40), it’s important to me.

- In both cases, you can easily open accounts online. It’s extremely important to me because I like to save money towards purchases as opposed to borrowing money. However, with Tangerine you can also close accounts just as easily. Say you’ve finally saved money for that special vacation, paid for it, and now you can close that account with a click of a button. President’s Choice Financial doesn’t let you do that.

Round 4: ATM Network

Best Savings Account - Tie

For some people access to an ABM is important. Personally, I do all of my banking online including deposits, and I have no use for automatic bank machines. But some people still do (just like some people still use rotary phones!), so I’ve decided to compare number of ABM machines available locally for each bank. Now, in your city it might be different, so do your homework.

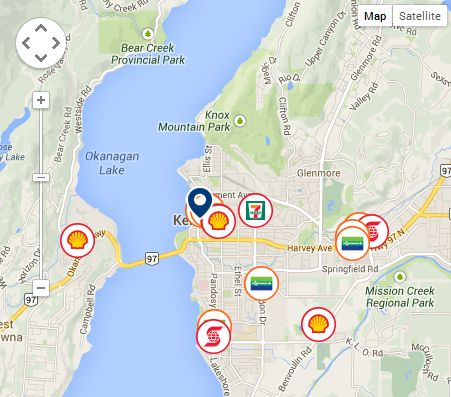

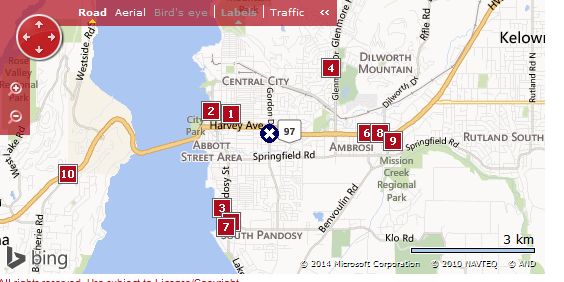

In my city of Kelowna, both banks had fairly similar ABM presence:

Best Savings Account - Tangerine ATMs

Best Savings Account - PC ATMs

Depending where you live, winner in this category might be different. In my case, it’s fairly close with Tangerine being slightly ahead.

Round 5: Customer Service

Best Savings Account - Tangerine Wins!

This is more of a personal opinion on this matter, but I always enjoy calling Tangerine. Their agents always sound cheerful and happy to help you, and will go out of their way to make a difference. Even when I ask inane questions (” - How do I deposit a US cheque into my account?”), it gets answered right away and necessary changes are made on the fly.

President’s Choice Financial agents on the other hand are … meh. Take for example my latest experience with them when I called and asked for an NSF fee to be waived. Sure, they did what I asked them to do, but the overall feeling was that I just called a sweat shop. Their employees usually sound like they hate their job and would rather stick needles in their eyes than be talking to me.

I’ve even approached Tangerine on Twitter to ask them a question, and received a response within minutes. President’s Choice? Still waiting.

Conclusion: Tangerine Wins The Showdown!

New kid on the block (and by “new kid” I mean “an established and trusted company that just been acquired by Scotiabank and re-branded as Tangerine”) wins the battle. Yes, President’s Choice offers a good product and doesn’t charge for it, but Tangerine offers many extras that come in handy. On top of it, Tangerine’s customer service is top notch. For all of these reasons, I can confidently say that Tangerine offers the best savings account for their clients.

BONUS: Would you like some free money?

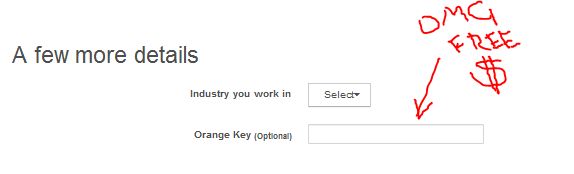

Right now, you can earn up to $150 in free money and take advantage of 2.50% interest rate if you sign up for Tangerine account online. Yes, absolutely free money. All you have to do is sign up online, provide my Orange Key when you open your account, and Boom! - FREE MONEY! Hopefully the information I’ve provided you with today is worth the hassle of entering my referral key when completing your quick and easy online application.

To get free money, complete these three easy steps:

1. Go to Tangerine Bank

2. Locate “Tangerine Savings Account” in the list and click “Enroll Now”

3. When filling out all the personal information, enter my Orange Key 31294793S1

Best Savings Account

Both you and I will enjoy some free money. No work involved besides signing up for an account. Life is beautiful, eh?

I have both. I use PC for my day-to-day banking (and my planned spending account), but all my larger savings goals are with Tangerine. My biggest pet peeve with PC Financial is that you have to wait a day to transfer money from savings to chequing. And since I have my planned spending money in a savings account with PC, it aggravates me any time an expense comes up where I need to transfer money. I love the free cheques forever from PC though, which is why I use it for my day-to-day banking (to pay my rent).

I actually have both too We use ING for all our savings and PC for day to day. At this point we can easily switch to just using Tangerine (ING) because they also offer checking account, but for some strange reason I like having a bit of firewall between our checking and savings account - less access I have to money the better. Like a seasoned alcoholic, I need to limit access to my own money:) Silly, I know…

We use ING for all our savings and PC for day to day. At this point we can easily switch to just using Tangerine (ING) because they also offer checking account, but for some strange reason I like having a bit of firewall between our checking and savings account - less access I have to money the better. Like a seasoned alcoholic, I need to limit access to my own money:) Silly, I know…

Does Tangerine charge for checks? Didn’t know that.

The first 50 are free, but after that you need to pay. Which most people won’t run up against too quickly because many people don’t use cheques that often any more. I think I’m an odd duck for still using them, but it’s what my landlord wants. And it’s how I’m paying off my personal loan, etc. So they add up.

I’m all for the firewall between easily accessible money! I recently went on a trip and I put all my spending money in my ING account because I didn’t want to somehow accidentally dig into my rent.

Just a quick correction, Tangerine was acquired by the Bank of Nova Scotia (Scotiabank) and not HSBC

Sarah, oh my, you’re absolutely right. Thank you for pointing this out

Hey there, thank you for making this thorough and thoughtful comparison.

I’m going to be switching to a no-fee banking account within the next few weeks, because I’m currently paying over $130 a year in fees to TD (ouch). My main plan has been to go back to PC Financial. They were my first bank when I got my first job (at Superstore, conveniently). I know what I’m getting there, so it offers some peace of mind. There’s also comfort knowing that I get free cheques forever, in case I ever move somewhere that requires rent in cheques. Other than that, however, I really don’t use cheques ever.

However, with this excitement about the newly rebranded Tangerine, it’s got me thinking. Yes, their cheque books cost an additional $12.50 after the first one, but like I said, I really don’t ever use them. One other interesting point about Tangerine is that email money transfers don’t cost anything, while regular email money transfers at most other institutions cost $1.50. If you’re paying, say, monthly rent by email money transfer, that’s $18 per year. So, maybe, all things considered, Tangerine comes out on top here too.

However, both PC Financial and Tangerine currently offer substantial rewards for signing up right now. By opening new chequing and savings accounts, as well as setting up direct payroll, you can earn up to $150 with each. (PC Financial rewards you in PC points, however, but if you shop at Superstore you’re good.) Tangerine additionally offers $25 for using someone’s referral code when signing up.

So, I’m starting to think, why not set up accounts with each, and reap the rewards of both. That way, I additionally get to try each one out, and see which one I gravitate toward over the years. There’s also the good idea posted above about using one for everyday banking, and the other for long-term saving.

One thing I’m wary of with PC Financial is their lackluster customer support. I remember this from many years ago, as well as reading more recently peoples’ anecdotes on the internet. Things like having to wait an hour on hold on the phone with them, as well as just a depressing attitude in general. On the other hand, I hear nothing but great things about Tangerine’s award-winning customer service. They just seem more youthful, hopeful and forward-looking as a company in general. But to be fair, PC Financial is attractive because I know exactly what I’m getting, they’ve been around for years, are tried and true. They seem like they’re not going anywhere, which I can’t completely say about Tangerine, under its new acquisition.

So yes, I might open two accounts. After all, they’re both free, and I can also close one of them if I really feel I want to, at any point.

Hey N,

Thank you for your thoughts. Like I’ve mentioned in one of my comments, I actually have both. ING/Tangerine is my savings powerhouse with all the savings accounts set up, and PC is our main checking account. While we can easily use just Tangerine, for some reason I prefer to have a bit of a firewall between our savings and our savings - this way I can’t spend money too easily :))

President Choice also have a good points system that we use all the time to buy groceries - so, it does have its benefits.

Open both, see how it works for you. You can always close one of them

Thanks for sharing your thoughts!

Thanks for your reply, Financial Underdog. I’m opening my PC Financial account tomorrow, and maybe also my Tangerine. I think I’ll try the setup you described, too. Your website helped me make my decision. Thanks and take care!

By the way, thank you for using my Orange key