Recent Posts

I hate cash - and here is why...July 14th, 2014

I Hate Cash I hate paper bills in my pockets (even though new Canadian bills are now actu[...]

Seven budgeting myths I will bust for you (number 2 is my favorite!)July 1st, 2014

Budgeting myths need to be busted Here's the thing about exercise. Nobody really wants to[...]

Best Savings Account - Tangerine vs. President's Choice. The Ultimate Showdown!June 23rd, 2014

Best Savings Account -President's Choice Financial or Tangerine? When it co[...]

Book giveaway! David Bach - Smart Couples Finish RichJune 16th, 2014

Hey, who doesn't like free stuff? I'm giving away a copy of David Bach's Smart Couple[...]

Why do immigrants save more money?June 9th, 2014

Did you know that Canadian immigrants save more money? WARNING: This article is full of s[...]

Mid-year update: Goals and Resolutions – 2014June 2nd, 2014

Goals an resolutions strike back! Holy macaroni, does the time fly or what!? Feels like o[...]

Dear Debt ... it's been a whileMay 23rd, 2014

Dear Debt, It's been a while since we've talked. Five years ago I've walked out on you. F[...]

Recent Comments

Financial Underdog { You know what, this is a great tip - I should take all the change I've collected over the years and just dump it into... } – Jul 15, 8:34 AM

Financial Underdog { You know what, this is a great tip - I should take all the change I've collected over the years and just dump it into... } – Jul 15, 8:34 AM Alicia @ Financial Diffraction { I have done that too. I guess I don't have quite the aversion to it because I carry a wallet that has a change purse.... } – Jul 15, 6:31 AM

Alicia @ Financial Diffraction { I have done that too. I guess I don't have quite the aversion to it because I carry a wallet that has a change purse.... } – Jul 15, 6:31 AM N { Thanks for your reply, Financial Underdog. I'm opening my PC Financial account tomorrow, and maybe also my Tangerine. I think I'll try the setup you... } – Jul 14, 8:50 PM

N { Thanks for your reply, Financial Underdog. I'm opening my PC Financial account tomorrow, and maybe also my Tangerine. I think I'll try the setup you... } – Jul 14, 8:50 PM Financial Underdog { Well, here's a real world example. I actually tried the so-called "envelope system" and it just pissed me off to no end. You're supposed to... } – Jul 14, 7:56 PM

Financial Underdog { Well, here's a real world example. I actually tried the so-called "envelope system" and it just pissed me off to no end. You're supposed to... } – Jul 14, 7:56 PM Alicia @ Financial Diffraction { See, I find cash more tangible than plastic. Maybe I'm just not as evolved as you, but I need the concrete feel of money going... } – Jul 14, 7:31 AM

Alicia @ Financial Diffraction { See, I find cash more tangible than plastic. Maybe I'm just not as evolved as you, but I need the concrete feel of money going... } – Jul 14, 7:31 AM Financial Underdog { Hey N, Thank you for your thoughts. Like I've mentioned in one of my comments, I actually have both. ING/Tangerine is my savings powerhouse with... } – Jul 13, 10:00 PM

Financial Underdog { Hey N, Thank you for your thoughts. Like I've mentioned in one of my comments, I actually have both. ING/Tangerine is my savings powerhouse with... } – Jul 13, 10:00 PM

Yearly Archives: 2014

Overdraft fee? Are you #$!@% kidding me???

Overdraft fee? Are you #$!@% kidding me???

Overdraft fee on our account?

I am truly embarrassed. Just few weeks ago I rambled in lengths on how you should avoid getting overdraft fees by knowing when payments are supposed to come out of your account, and always making sure you have enough money in it. “Oh, only extremely dense people would let their account get overdrawn! You’re better than this!”

Well, guess what. I log into Mint.com (which is the best money management website ever, just FYI) on Friday, and I see that we’ve been charged an NSF fee. What the hell?

Overdraft Fee

Why did this happen?

For ages, my paycheck came into our account on Thursday night. On Friday morning, our mortgage payment would leave our account. I specifically picked every other Friday for our mortgage payments just so it is the same day as payday and I knew we would have money in our account. It’s always been like this, and it never changed once.

In fact, I started counting on this lately. Because we have rather aggressive savings goals this year, last few weeks I’ve been living a bit on the edge. I would move money between our checking and saving accounts trying to hit our goals rather aggressively, to the point that sometimes I would leave almost nothing in our chequing account. Out of my determination to hit our goals which borders on stubbornness, I flew a bit close to the sun. Counting once again that my paycheck will appear first in our account followed by our mortgage payment, I left our account too skinny.

But this Friday Murphy’s Law prevailed, and our mortgage payment showed up before my paycheck. Boom!

It doesn’t matter that my paycheck arrived shortly after. We didn’t have enough money in the account to cover the mortgage payment. And as a result, our bank refused the payment, issued an overdraft fee, and when I saw this I almost spilled coffee on myself. After all the hard lessons that I’ve had in my life when it comes to finances and preaching on my part how you should always be aware of your cash-flow, did I just cause an overdraft fee on our account?

Whose fault was this?

I’m not going to make up excuses for myself. It was 100% my fault for letting my stubbornness get the best of me. Yes, it’s great to have goals for your finances, and work hard on hitting them. But you should never leave your net empty, when you send your best players across the field to score some goals (yes, this is a hockey reference). This can have very dire consequences.

To add insult to injury, just few weeks ago my wife checked our account and noticed we’re flying unusually low to the ground - meaning we have unusually low account balance. She expressed concern about it, but I brushed it off. “- Don’t worry, honey. Your man will never let anything bad happen, I’ve got this!”

Overdraft Fee

What a perfect I-Told-You-So moment. Kill me now.

First results:

- $45 overdraft fee courtesy of President Choice Financial (our checking account) already been charged.

- $75 NSF fee courtesy of Macquarie Financial (our mortgage holder) that will follow.

- A huge load of embarrassment for me. Is this what crow dinner tastes like? Yuck!

I jump into action!

Fueled by my own embarrassment, I jump on the phone. Obviously, I can’t just ignore this rather negative event, but I also know that if I’m pro-active, it’s possible to avoid paying some of the fees. My plan is to beg for forgiveness until they stop me!

First I call our mortgage company and explain the mix-up to the best of my abilities.

Me: - Hello! My deepest apologies, but it seems to me that we’ve bounced a payment this morning. I just wanted to let you know that I’m truly sorry about it, and you can already debit our account for the full amount.

Very nice CSR: - Oh, I see. Thank you for letting us know and saving us time. We’ll debit your account shortly, and since this is the very first time you’ve bounced a payment, we’ll waive the NSF fee.

Me: - OMG, thank you so much!

Next, I call our bank and talk to them:

Me: - Hello! I just wanted to apologize for overdrafting our account this morning.

Very tired and emotionally withdrawn CSR: - Uhmmmm…ok.

Me: - Any chance you can remove the overdraft fee? This is the first one on our account.

Very tired and emotionally withdrawn CSR: - Not really, no.

Me: - I’ve been a client of this bank for a very long time; we have a number of products in our name. What can you do for me?

Very tired and emotionally withdrawn CSR: - Well, let’s see. I can probably meet you half-way. How does $20 instead of $45 sound?

Me: - Not nearly as good as a zero charge. Give me a break, it never happened before.

Very tired and emotionally withdrawn CSR: - Oh, fine. But next time you overdraft your account, this trick won’t work.

Me: - You’re the best. Won’t happen again!

Final results:

- President Choice Financial reimburses the overdraft fee within days:

Overdraft Fee

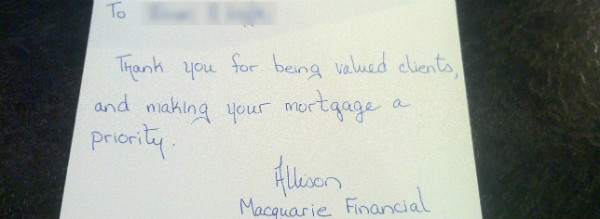

- Our mortgage company sends us a postcard. How nice:

Overdraft Fee

- We avoid paying $120 for my stupid mistake.

- Lesson #1: No matter how bad I want to hit our financial goals, I can’t live on the edge, and we should always have buffer in our daily account. Ideally, at the beginning of the month I’d like to have enough money in our account to cover all our expenses for the month. This way we never have to “time” our bills and paychecks.

- Lesson # 2: You can talk your way out of some overdraft fees. Of course, this won’t work if you constantly overdraft your account, but if you make a stupid mistake once in a while, banks can be surprisingly forgiving.

- Lesson # 3: My wife is one smart cookie ![]()

Overdraft fees by the numbers:

- Average overdraft fee charged by major banks is $34.

- Overdraft and non-sufficient funds fees accounted for 61 percent of total consumer deposit account service charges in 2011

- The amount in annual fees, on average, for accounts that had at least one overdraft or non- sufficient funds fee - $225

My 13,940% risk-free investment

My 13,940% risk-free investment

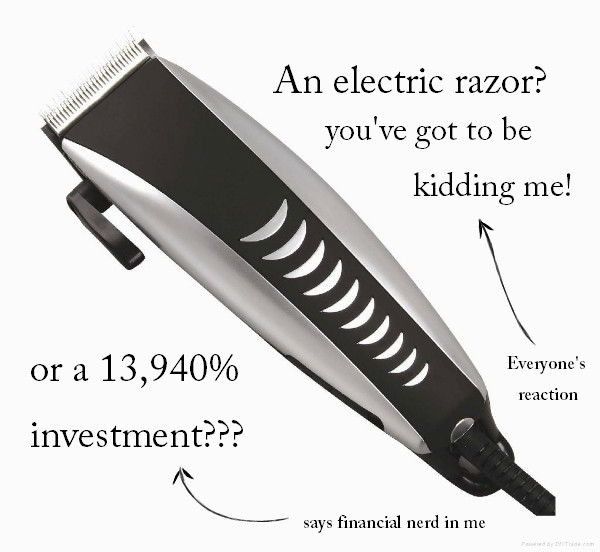

What if I said there is a risk-free investment with 13,940% profit over time?

Now, at this point you would probably laugh at my face. First of all, the return figure is way too high and comes close to that of Apple. Second, there is no such thing as risk-free investment besides GIC’s and money market accounts (and they return around 2% these days - barely keeping up with inflation).

But my investment does exist. And the returns are real. And they are indeed risk-free! And I’m not even Steve Jobs.

My 13,940% investment

Risk-free Investment

Now, before you close this page and/or start writing me an angry email about being misled, hear me out:

- I’ve always had short hair, at least since high school. Longer hair doesn’t look good on me. So, at some point I just started getting my head shaved. Every two weeks, I’d stop by a barber to make sure it doesn’t get out of hand - but then an idea of doing it myself and getting an electric razor popped into my mind.

- My initial investment on it was $20. You can get it cheaper, but I went with quality in mind. And the quality paid off - the thing never let me down.

- I used to visit a barber to get my hair trimmed every two weeks, or 26 times a year. Each barber visit costs roughly $12.

- For the last 9 nine years, I’ve been trimming my own hair thus saving me $2808 in total (26 times * 9 years * $12)

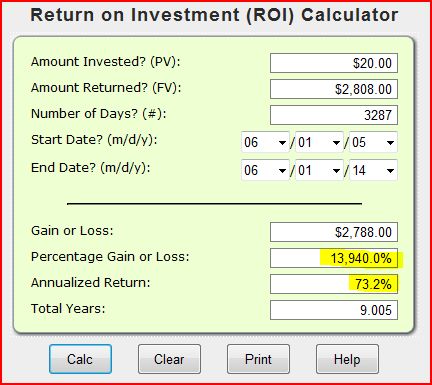

Let’s plug these numbers into investment calculator to find out the return on my initial $20 investment:

Risk-free Investment

Total investment return: 13,940% (just below Apple’s stock returns of 15,000%)

Annualized return: 73.2% (average stock market return - 11%)

Risk factor: NONE (but the risk of being mistaken for Bruce Willis still exists!)

On a more serious note

Of course, I’m not trying to say that buying an electric hair trimmer is a real risk-free investment. The whole thing is meant as a joke, relax. It’s not really an investment, it’s just a razor that happens to save me money because I’m not very touchy about my looks and it makes my life easier. And I’m not trying to say that everybody should start shaving their heads to save money! I sure would not like if my wife started shaving her head - even if it made her look like Sinéad O’Connor (not that she would ever willingly do that no matter how much money it saves).

I think my main point is that if you are struggling with money or have goals of reaching financial freedom one day, you have to start thinking with long term in mind. I didn’t have a good start when it comes to finances, but I’m still trying to reach my goals by changing my financial habits.

Every single transaction/event in your life is either a benefit or a detractor to your financial well-being. You have to pay attention to them and know their long term effects when it comes to your financial picture. For example, ask yourself how these events affect you in the long run:

- Does getting your daily morning coffee on the way to work benefit you financially?

- What would going back to school and getting an advanced degree mean to your income and how it would stack up against the short term expense of school fees?

- Is getting a brand new car a sound financial decision and can you truly afford it along with higher expenses it brings?

- What makes more sense - paying off your mortgage earlier by throwing more money into it monthly or investing extra money and getting a higher return on it?

- Is commuting 50 kilometers every day to a higher paying job worth it despite higher transportation costs?

Biggest mistake people make

Just from talking to people and observing their decisions, I’ve noticed that most people don’t think their financial decisions through, no matter how big or small they are. Most people act on impulse, follow the herd, and don’t really pay attention to their financial picture. And this is the biggest mistake people make - not paying attention.

Maybe all of us should become a bit financially nerdy - start paying attention to our expenses, weigh options against each other, and think of long-term repercussions of our actions. You might not want to calculate the return on investment of a simple hair trimmer like I did today or calculating amount of money lost on smoking, but just paying a bit more attention to your financial health will be beneficial to you and your family in the long run.

Do you calculate returns of your everyday “investments”?

Financial lessons I’ve learned in my 20′s

Financial lessons I’ve learned in my 20′s

Financial lessons can be learned in different ways

Just like all life lessons, you have to learn financial lessons somehow. Life lessons can be taught by your parents if you’re open to them. They can also be learned in school if the school program includes financial basics for youth. Unfortunately, in my case I had to self-teach myself financial literacy through trial and error. This usually is accompanied by great financial pain.

As I’ve explained before, I didn’t have a good starting position for myself in my life journey when it comes to financial literacy. Being an immigrant from another country where economy and money function in a completely different fashion, it was literally like being an alien from another planet (but no lightsaber). I didn’t have basic knowledge of personal finance when I’ve arrived. I didn’t know what one is supposed to do with money. Economy as a whole was a complete mystery to me. Unfortunately, my parents were in the exact same position so they couldn’t teach me Personal Finance 101. I was also too old for high school where they teach it.

When it comes to personal finance, some of the concepts that are familiar to any average Canadian were in fact completely foreign to me. For example, I didn’t know how credit cards work and how much they can cost you if you don’t pay attention to your balance. I had no idea bank will lend you the money for just about anything as long as you pay it back with steep interest. Saving for the future retirement seemed unnatural since my grandparents back home were enjoying government provided pensions for life. All of a sudden, I had to learn all of it - and sometimes through great financial pain.

Financial Lessons

But sometimes pain is exactly what you need. If you burn yourself on a stove once or twice, you learn to avoid touching it at all cost. Your brain will scream at you “Hold on there, sport. Last time you did that it hurt like hell!” Financial lessons for me were exactly the same. Sometimes painful, but as long as they taught me something they were be quite useful. I’m glad for all the pain they caused me; I just wish I could have learned these financial lessons sooner:

Live on a budget

As a young man of twenty something, living on my own and fresh to this beautiful country, I didn’t know how to handle money. More importantly, I didn’t know how to control what little money I had. Money was coming in, bills were coming out. It was a never ending cycle of debits and credits to my account with no rhyme or reason.

My only limitation to spending money was my bank account. If I had money in my account on Friday night, I would go on spending it. If I didn’t have any money in my bank account, I would stay home. Same principle for all purchases, really. Basically, I would make my decisions on what I had at the time. As a consequence, sometimes my expenses would be much higher than my income.

Then I discovered a new way to live financially. I’ve started to base my decisions off what I had coming in. If I had $2,000 coming on one particular month, I would map out how I would spend this money ahead of time without paying attention to my bank account. Two thousand dollars comes in, two thousand dollars get spent. Bank account money doesn’t get touched as it would mean spending more money than I have coming in - and that is unacceptable.

People usually cringe when somebody mentions “budget” because budget means limits and boundaries. But if you think about it, budget just means putting together a plan on spending your money. It’s actually quite liberating.

Once I’ve learned how to budget and changed my perspective on spending, I’ve started putting more thought into planning my everyday finances. Saving towards big purchases became a second nature to me as I’ve started automatically set saving goals for myself. Need a new laptop for school? Figure out how much you want to spend on it, how much time you need to save it, and how much you should be putting away monthly towards it. Now some of my paycheck is going towards the laptop - instead of me just checking my bank account to see if I can buy this laptop right away or even worse - borrowing money for it (more on this later).

I didn’t learn budgeting overnight. Little by little, I figured out what works for me and what makes most sense. But if I could have learned about budgeting earlier, I bet me and my family would be further ahead in life right now. But hey, as long as we’ve learned it at some point.

Say “NO” to acquiring stuff

You don’t really need a lot of stuff in your life. Some items are quite necessary such as transportation, shelter, and basic clothes. But anything above your basic needs is not essential and spending money on acquiring more and more stuff can turn your happy existence into a vicious cycle of never-ending work and spending.

Imagine yourself camping and sitting next to a fire. A few small logs can provide you with ample heat for the night. You don’t need to shove more and more logs into the fire; while big fire might be impressive, it doesn’t match your needs. On top of it, you’ll have to work very hard on controlling it and continuously running into the woods to get more firewood. Why bother?

Same approach with money. You can make your life all about earning more and more money, and spending it all. Your 4,000 sq. feet house will be surrounded by beautiful landscaped land, German cars will sit in your 5-car garage, and you will spend 360 days at work while stressing over your financial situation and never seeing your family.

Financial Lessons

I’ve learned that I prefer simple life (and I don’t mean that awful TV show with Paris Hilton). It doesn’t mean that I want me and my family to live like monks. But driving a used car with much lower expenses as opposed to leasing a new BMW can be quite beneficial as it gives me more money to invest, and lowers the stress by improving our financial situation.

We can probably afford a bigger house for ourselves if we borrow as much as bank will give us. Still, we’ve decided against it because living in a nice condo meets all our needs. Sure a big house would be nice and would probably impress our friends - but big houses come with big problems and higher expenses, once again. For example, we can easily repaint our little townhouse ourselves over one weekend. What if we lived in a 4,000 sq. feet house? Repainting it would probably require hiring professional painters and thus opening our wallet and saying goodbye to a considerable amount of money. Simple just makes more sense for me.

Invest early and regularly

It took me quite some time to understand the importance of investing. For this, I had to completely change the way I was thinking about investing.

This is the way I used to think about investing:

” You work all your life and get a paycheck every two weeks. You put away money for your retirement. A little of your paycheck goes towards your life in your senior years. You slowly build up a retirement fund for yourself and your family, and once you have enough you start taking from it and can stop working. As long as your money outlives you, you’re golden!”

But what twenty something person really thinks about senior years? The prospect of buying something cool right now outshines any future needs. Especially when you’re talking about your paycheck - after all, we all work very hard for our money and want to enjoy the paycheck right away. My senior years are so far ahead of me that saving for them just didn’t make sense. Let me in my 20′s enjoy life a little bit, perhaps me in my 30′s or even me in my 40′s will take care of me in my senior years! For now, New Sony Playstation, here I come!

Here’s how I think about investing now:

“You work every day and get a paycheck every two weeks. A little of your paycheck goes towards your freedom fund. The money collected in your freedom fund starts producing income. If you have a little freedom fund, it produces a little stream of additional income. If your freedom fund is substantial, it produces a substantial stream of income. Whether or not you still work, it still produces income. If this income is high enough to live off, guess what - you can stop working and still receive paychecks in the mail every two weeks. Income without work is a beautiful thing!”

For some reason, this way of thinking about retirement really changed my perspective about investing. Imagine being able to cover all your living expenses with your investment income instead of working to pay your expenses when you’re old and retired. If you live a simple life, you don’t really need a lot of money to retire - a moderate stream of income will cover all your expenses without waiting till you’re in your 70′s to retire.

So now I think of investing as building that addition stream of income. Saving money towards it feels meaningful and investing became one of our primary goals.

Never borrow money.

The concept of borrowing money from a financial institution was quite foreign to me when I arrived in Canada. Up until then the only borrowing I’ve done was through friends - very small sums of course. My parents would sometimes borrow money from their friends when our funds run out at the end of the month to buy groceries. But Canadian borrowing is much different.

Here you can borrow money for pretty much anything. School classes, everyday purchases, vehicles, clothes, housing, and even home pets. Yup, apparently some pet stores will lend you money to buy a puppy.

What did it all mean to me back then? FREE MONEY! Everybody wants to give me money so I can buy stuff, how awesome is this? I can buy stuff right away, and pay it back later once I make money by working! I’ve borrowed money for night school - and boy, was it easy. First day on campus, a major bank was giving out credit cards - and I’ve signed up right away. Then I borrowed money on it to buy everyday things - as long as I could afford minimal payments on it. My paychecks (already pretty low) were spoken for by the time they hit my pocket. Fairly soon, I’ve started falling behind. Soon after, I’ve learned what it’s like to receive a phone call from a collection agency.

Just like the proverbial hot stove, I’ve burned myself on borrowing money a few times before I’ve learned my lesson - never borrow money. If you have to borrow money, it means you’re broke and don’t need whatever you’re about to buy. If you can’t pay for something in cash, you can’t afford it, so move on. Major financial institutions make serious money by lending it to people, and by borrowing money you’re willingly handing over your cash to them just to enjoy something right away.

You don’t need to hand over your cash to a bank just so you can buy a puppy - just save money, and buy it yourself. Remember that when you borrow money you have to pay it back. If you want to buy something for $100 but choose to borrow it, you have to pay back the original $100 PLUS $20 in interest. Interest becomes an additional expense to you and a nice source of profit for your bank. Don’t you have better use for your $20?

I don’t know about you, but I don’t like my bank enough to give them money for nothing. Housing would probably be the only exception to this rule.

Five Useless Financial Products

Five Useless Financial Products

Let’s start a list of useless financial products

While some financial products can truly by lifesaving, not all of them are. Some of them are truly useless in my opinion, and I can’t figure out why people even consider purchasing them.

- Personalized cheques ($60)

I can never figure out why anybody would pay extra money to have personalized checks. I understand that some people feel the need to express themselves, but I can’t imagine form of payment being a good medium for it. We already have plenty of questionable ways to express ourselves - bumper stickers and stick figure families on your cars. But personalized cheques? Whom are you trying to impress with your dolphin-themed cheques? Your local ATM machines? Most cheques you send through mail to pay bills (if you’re one of the seventeen remaining people that do it) get deposited automatically without people even looking at them.

Useless Financial Products

On top of everything personalized checks cost money. In my mind, you might as well burn $60 (the average cost to order customized cheques) and be done with it. Or send it to me, I’ll find a better use for them.

- Overdraft protection ($5/month or more)

Overdraft protection works like this: If you run out of money on any given day but another expense comes in, the bank still processes the payment and charges you a small fee per day until your bring up your balance (in addition to your monthly fee). In reality, you’re paying your bank a fee to cover your ass.

Here’s a simple solution - keep an eye on your bank accounts, and make sure you have enough money to cover all expenses. Granted, we all been there. I’ve bounced a few checks myself when I was broke and an unexpected utility bill would show up out of nowhere. But in every single case, it happened because I wasn’t paying attention - and paying your bank more money to cover your butt is a terrible solution. A better solution is to start paying attention.

Ideally, you want to have enough money in your account to pay for all your monthly expenses at the beginning of the month. This way you never have to worry about dipping below the liquidity line. But if you’re not quite there yet, figure out when your bills clear your account and be proactive.

- Mortgage life insurance

I’ve already covered mortgage life insurance in one of my earlier posts. It’s designed to pay off your mortgage if the mortgage holder (you or your spouse) suddenly passes away. Sounds like a good idea?

In reality, mortgage life insurance protects your bank more than it protects you and serves as an additional revenue source for your bank.

- Mortgage life insurance is not flexible enough.

- It is generally way too expensive when compared to a simple term life insurance.

- You can run into problems with collecting money from it.

- Christmas dinner prepayment plans

Recently, I’ve seen an ad on TV for prepaid Christmas dinner. The plan is pretty simple - the company debits your account once a month twelve times straight, and once Christmas comes it delivers a beautiful dinner to your door - complete with turkey, wine, gravy, and all the other fixings. Sounds delicious, but is it a good financial product?

Useless Financial Products

First of all, you’ll be greatly overpaying for this dinner. Not only you pay for all the products at inflated prices, but you also pay company profit (they wouldn’t do it just for nothing, am I right?), and marketing costs including the cheesy ad on TV. Second, you’re basically hiring somebody to take money from your account and put it aside for later use. Isn’t that something you can easily do yourself?

Simple solution: figure out the cost of your Christmas dinner, divide the amount by twelve, and setup an automatic bank transfer into this savings account. Takes about 10 minutes! Twelve months later you’ll have the money ready for your Christmas dinner without overpaying for it. Same result at much lower expense. In our family, we take the exact same approach with gifts and presents, and it works out beautifully!

- Extended warranties

Last time I bought an MP3 player at a local electronics store, I was surprised to be offered extended warranty for it. Seems to me they now offer extended warranties even on smallest items imaginable - from toasters to shoelaces. The salesperson explained in lengths how extended warranty protects my investment (by the way, it’s not an investment!). Being a big financial nerd, the whole premise of extended warranty is laughable to me:

Useless Financial Products

- Most products these days are fairly reliable, especially if you go after higher quality brands and do your homework. They might not last you a lifetime and get passed on to your kids (not that they’ll want it anyway), but most likely they will last past the date the warranty expires.

- Most likely, you already have extended warranty with your credit card (provided you pay for things with credit cards). Most cards issued today automatically double the manufacturer warranty offered for the product making extended warranty somewhat useless.

- A lot of stores offer hassle-free return policy that once again makes extended warranty useless. If you have Costco membership, you can bring any item you’ve purchased back if you’re not happy with them, and they’ll refund your purchase without asking questions. No need for extended warranty.

Overall, extended warranty on smaller items became yet another highly profitable revenue source for stores and provides very little benefit to an everyday consumer. To me, extended warranty on cheaper items is one of the most useless financial products.

I’m sure you can think of few more. Share them in comments!

How I puffed away (some of) my retirement - and other benefits of quitting smoking

How I puffed away (some of) my retirement - and other benefits of quitting smoking

My history of smoking

Just recently, I’ve celebrated five years of being a non-smoker. Five years ago, I’ve decided to quit this nasty habit, and puffed away my last cigarette. It wasn’t easy, but after some serious thinking about smoking and its benefits (none), amount of money I was spending on it, and countless other benefits of quitting smoking - I’ve made my choice and threw away my last pack of cigarettes along with my lighter.

As I might have mentioned before, I grew up overseas in Russian Siberia. Unfortunately, smoking is much more prominent there as it is in Canada, especially among youth. Just to give you an idea, according to Wikipedia people smoke 3.5 times more as they do here in Canada. Good news for Canada is that smoking rates have been plunging steadily as more young people don’t even try smoking and don’t get hooked on cigarettes.

Benefits of quitting smoking

Unfortunately, I was one of the kids who picked up smoking somewhere in high school. Since almost everybody smokes in Russia (at least this is what it looks like), smoking seems fairly normal, and hence it’s one of those things kids want to try. First it was few smokes in between classes (mostly to look cool). Then it became a social habit of smoking while hanging out with my friends. After becoming an adult, it became an everyday habit. I just had to have a smoke in the morning with my coffee, one at the end of the day “to relax” (which by the way is a complete lie), and countless others in between. By the time I was in my mid-twenties, I was smoking roughly two packs a week. It’s pretty light by most smokers’ standards, but nonetheless it was still a nasty habit, and it was starting to affect my health.

I’ve noticed regular headaches that would always creep up on me towards the end of the day. My blood pressure was above the norm. Sometimes, I had troubles sleeping and would venture outside for a smoke in the middle of the night. On top of everything, I almost always lacked energy and felt depressed. Ask any smoker, they have probably experienced these exact symptoms.

But it all changed as soon as I quit smoking.

Financial benefits of quitting smoking

Since I mostly ramble about financial matters, let’s take a look at how much money I have wasted by smoking. Let’s say I’ve been regularly smoking two packs a week for five years. Presently, the cost of cigarettes is around $9.00/pack.

5 years of smoking = 2 packs @ $9.00/pack * 52 weeks * 5 years = $4,680

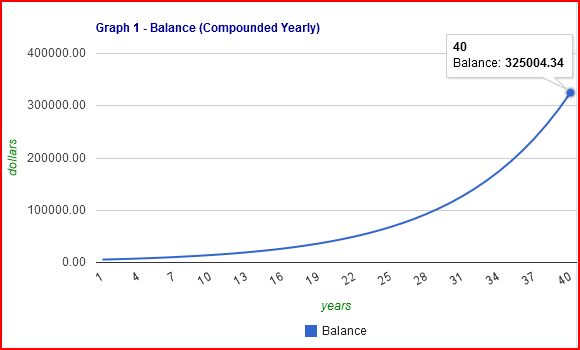

This means I puffed away roughly five thousand dollars in just five years when I was smoking regularly. Now, before you say that $5,000 isn’t really a retirement fund, plug that number into any compound interest calculator - and you will find out how much money I’ve really puffed away by spending $5,000 on cigarettes instead of investing this money:

Benefits of quitting smoking

What does it mean? It means that by smoking 2 packs/week for only five years, I’ve puffed away $325,000.34 that I would have had in 40 years if I simply invested that $5,000. Not exactly a retirement, but a very good chunk of it, don’t you agree?

Just in case you need some visualization, here are just some of the things I could buy in 40 years with my cigarette money:

4 bedrooms, 3 bathrooms, 3,100 square feet house in San Antonio:

- Benefits of quitting smoking

Lotus Elise (zero to 100 km/h in 6 seconds, baby!):

Benefits of quitting smoking

LeBron James’ engagement ring:

Benefits of quitting smoking

While I wasn’t spending a lot of money on cigarettes, quitting smoking still benefited us financially as it gave us more cash in our pockets without doing more work. It was like getting a small raise without asking for one. More money means we can invest more money towards our goals, and hopefully reach the proverbial financial independence sooner. At the end of the day, quitting smoking is like finding free money every week.

Other benefits of quitting smoking

Aside from financial benefits of quitting smoking, there are myriad of others.

1. I smell nicer (please don’t ask to verify)

2. My wife has one less reason to complain

3. I no longer experience crushing headaches and my blood pressure is perfectly normal

4. Running up the stairs doesn’t make me lose my breath for 10 minutes

5. I don’t have to stand outside in exile while everybody is enjoying a party inside.

6. Food tastes better

7. People no longer regard me as the worst person on this planet when I happen to walk by their kids

8. No need to see scary pictures they put on cigarette packs (seriously, they’re disturbing)

9. I save 5 minutes a day now by NOT coughing my lungs out every morning.

10. I can finally recognize basic shapes and patterns

Why you should quit smoking too

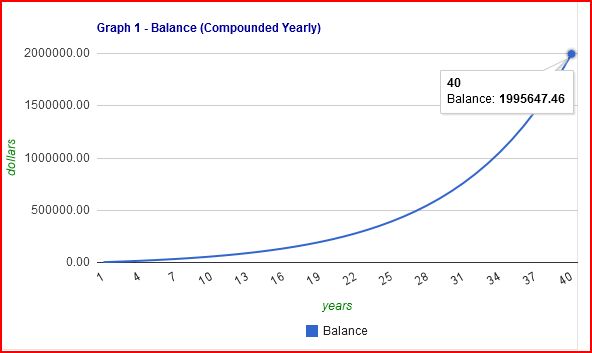

I hope you’ve opened your mind to how much smoking is costing you in the long run. Even if you only smoke for 5 years like I did, you will miss out on huge pile of money at the end of your working career; and the longer your smoke (or the more you smoke) the bigger that pile gets. Every time you light up imagine the house you’re puffing away, or a nice retirement fund. Somebody who smokes a pack a day will smoke through almost $2 million by the time they hit retirement age:

Benefits of quitting smoking

To be honest, I feel like nobody has the right to complain about not having enough money if they still smoke. You can give yourself an instant raise - if you quit this nasty habit. You’ll have more month left at the end of your money, and you can take care of your retirement by simply redirecting your existing funds.

Besides money, think of all the other benefits of quitting smoking. By quitting, you will improve your quality of life tremendously at no cost to you. This is a great investment right in front of you!

Do you smoke? What are you thoughts on this? Please leave me a message below.

How much money do Olympic athletes earn?

How much money do Olympic athletes earn?

Do Olympic athletes earn a lot of money?

With 2014 Olympics in full swing, everybody is talking about sports. While I’m not exactly an athletic person, I’ve always admired people who dedicate themselves to sports; especially if they get to the level of representing their country on the international scale - such as World championships and Olympic events.

At the same time being a huge financial nerd, I’ve always wondered if being an athlete pays anything. This is not exactly a regular job, isn’t it? You don’t work eight to five, you have to train a lot, you get to fly around the world, and quite often you’re asked to pee in a cup for drug testing. But do you make the big bucks?

You might want to get a real job

What do Olympic athletes earn?

Just being an Olympic athlete doesn’t actually make you a lot of money. Olympic athletes do earn a small stipend ($200-$2,000), and many of your expenses are reimbursed such as travel, hotels, and training camps. Your clothes will also be provided by the official sponsor - Hudson Bay Company in Canada and Nike in United States. Also, being an athlete with higher risk of injury, you are provided a special health insurance that covers sport-related risks and injuries.

So, at first glance being an Olympic athlete isn’t the best way to get rich quick. In fact, you might want to hold on to your day job in order to pay the bills. Being an athlete is far from being cheap as you have to invest a lot of time into training, eat properly, and buy specialized equipment. But there’s more money in sports!

Medals = Money!

In 2007 Canadian government announced it will be rewarding Canadian athletes financially for earning medals at high-level events such as World championships and Olympic Games. Just for that reason Athlete Excellence Fund (AEF) has been established. Funding comes from government (federal and provincial) and corporate sponsors. In 2012 over two million dollars went into Athlete Excellence Fund to support training, research, and athletes’ compensation.

What you stand to earn by grabbing medals:

$20,000 - Olympic gold medal

$15,000 - Olympic silver medal

$10,000 - Olympic bronze medal

$5,000 - Top 5 position in World Championship.

Canada is not the only country to reward their Olympic athletes for earning medals. In fact, some countries offer much higher rewards for earning gold at Olympic Games. Some of the numbers are truly mind-boggling:

What do Olympic athletes earn?

- Azerbaijan (I’ll give you $5 if you know where this country is located the prize has been claimed by one of my awesome readers!) will pay $510,000 to their athletes if they bring home gold medal from Olympic Games in Sochi. Out of four athletes from Azerbaijan (have you found it yet?), none are expected to bring any medals though.

- Singapore was ready to pay $800,000 for gold medals in London Olympic Games. No gold medals were earned by their athletes that year.

- In United States, government pays $25,000 to gold winners, $15,000 to those who earn silver, and $10,000 for bronze.

- On top of monetary compensation, some countries offer luxury cars, apartments, and even supply of food to those who bring home medals.

- British Olympic athletes earn absolutely nothing for their medals, but winning has other benefits. From the moment any take gold medal, Royal Mail will begin designing a stamp bearing their image and deliver them to 500 post offices for sale the following day!

Where the big money is!

But the main source of income for athletes isn’t financial rewards for medals. Most of the money Olympic athletes earn come from corporate sponsorships. Larger companies such as Nike, Nokia, Adidas, Gatorade, and many others want consumers to associate their products with high performing athletes. To do this, they sponsor selected athletes and provide them with steady stream of income sometimes reaching millions of dollars. In return, sponsored athletes wear their brands at sporting events, appear on their advertising, and participate in corporate events.

What do Olympic athletes earn?

Amount of money Olympic athletes earn from sponsorships can reach stratosphere but you must understand far from everybody can earn this. Most corporate sponsorships are much more modest.

Top ‘Olympic’ sponsorship earners (as of 2012):

1. Usain Bolt (Jamaica) - $20,000,000. Sponsors: Puma ($9m p.a), Visa, Gatorade, Nissan, Hublot, Virgin Media.

2. Kim Yuna (South Korea). - $9,000,000. Sponsors: Kookmin Bank, Nike, Korean Air, Hyundai.

3. Michael Phelps (USA). - $7,000,000. Sponsors: Speedo, Visa, Omega, and Under Armour.

My wife bought me a motorcycle. Kind of.

My wife bought me a motorcycle. Kind of.

For as long as I can remember, I always wanted to have a motorcycle.

I guess it’s one of these things guys like - motorcycles, battleships, machine guns, greasy burgers, and other gender stereotypes. Loud things and complete disregard for safety are very appealing to us - no wonder men don’t live as long as women.

When my wife asks me what I want for my birthday, I always say: “- No need to get me anything, unless you want to buy me a motorcycle.” I’m kidding, of course. And she always says, “- One day, when we have enough money, I’ll buy you a motorcycle for your birthday.”

And we laugh and go back to our daily lives.

However, for my birthday last week my wife gave me this:

My wife bought me a motorcycle

You’re probably now wondering if Mrs. Financial Underdog has somewhat cruel sense of humor. While she does tell me from time to time we’re having pie for dinner just to see me get excited for no reason, she’s generally a very kind non-cruel woman.

Then why would she give me a toy motorcycle?

As she quickly explained, while a real motorcycle is not exactly possible, it’s not always going to be this way.

And I completely agree with her.

See, right now we’re not financially set. We still have to go to work, have to make our own coffee because it’s cheaper this way, have to choose slightly cheaper detergent just to save $0.99. Every month we have to plan our spending - because we don’t have stacks of money lying around - and have to watch where our money goes.

At the same time, we’re doing everything we can to grow our investments in hopes that one day our money will be working for us harder than we have to work for our money (boy, that’s a bit wordy!). Every month we put a good chunk of our money away towards investments, throw some extra money towards the mortgage (more like bondage), and enjoy our simple lifestyle. No new cars for us, simple pleasures here and there, and a whole lot of dreams of things to come.

But one day it will change.

One day we’ll reach that financial independence everyone is talking about by following our plan. One day our investments will be producing a steady stream of income and work will become something we choose to do - not something we have to do. We will be able to take off and visit cool places once in a while. Maybe we’ll choose to buy ourselves some toys. And one day, I will choose to own that fancy motorcycle - and proudly ride around knowing that we did all the right things in the beginning of our journey, and now it’s time to enjoy the fruits.

We have to keep the future in mind - and stop focusing on today’s problems only. You can’t always look under your feet - once in a while you have to look up and see your destination getting closer and closer. Because this will give you energy and motivation to keep doing mundane “Left foot, right foot” routine every day and say “- Hey honey, we’re almost there. We’ll get there soon!”

My wife bought me a motorcycle

So, for now this little toy motorcycle will sit on my desk and remind me of our destination. Think of it as a symbol of that future, or a small advance against it. To be completely honest, I’m not even sure I’ll want to buy a motorcycle when we get there - maybe by that time flying cars will be all the rage. But it will sit here for now and remind me to keep going.

Left foot, right foot, left foot, right foot…

*****

PS: For those of you who thought this post is way too long to read, here’s a musical rendition of it featuring scenes from TV show “Kings of Queens”:

Three things I wish I knew before investing in mutual funds

Three things I wish I knew before investing in mutual funds

Investing in mutual funds is a great idea

One of my core beliefs is that you have to put money aside and invest it to make it grow. Mutual funds were my first choice for investing back when I’ve started educating myself about investing money in general. Simply saving the money in your bank or purchasing GIC’s is a sure way to lose money because of inflation. Inflation will slowly eat up your savings, and Guaranteed Investment Certificates (GIC) returns are extremely low and won’t protect you.

Investing in mutual funds

Investing in mutual funds sounds like a great idea for beginners, and in most cases mutual fund investing is a very appropriate choice. Mutual funds are extremely easy to purchase - if you can do online banking, you can purchase mutual funds. They’re diversified and in general it’s hard to lose all of your money with mutual funds. And what’s most appealing to me - you don’t need to manage them. You basically buy into a fund that is managed by a professional team; you personally don’t need to do anything but open up statements once in a while and watch your money grow (hopefully).

These were the reasons why one day I’ve decided that mutual funds are the best thing since cheese you put on sliced bread, and searched for a mutual fund company representative in my area. After sitting down with him, most of my savings that were sitting in the bank were used to buy mutual funds, and for the next little while I felt like Gordon Gekko in the making - after all, I now owned tiny pieces of some very large companies and large pieces of very tiny companies.

And in all honesty, it was a good learning experience for me - but I wish some of the things I’ve learned later were known to me before I bought my first mutual funds.

Mutual fund salespeople have to get paid

When you walk into a brokerage company ready to start investing money in mutual funds and start talking to an agent, make sure you know how they get paid. While it might be an awkward question to ask, I think this is one of the most important questions that need to be answered before any transaction takes place because not all mutual funds sales reps are created equal.

Quite a lot of them are paid on commission - these are usually employees of larger brokerage firms. They won’t charge you anything to do an analysis of your financial situation, and will purchase mutual funds for you through their company. Now, since nobody is working for free, the question is how do they get paid? They might receive a salary from the brokerage company, but in most cases, the majority of their income comes from commission paid by mutual fund companies for recommending their product. In some cases, sales commissions are their sole source of income.

This is where things get interesting - depending on the mutual fund their commission may vary. Some mutual funds choose to pay a higher commission for recommending their products, which in turns creates a conflict of interest, at least in my mind. If product A pays me $5,000 commission and product B (which may or may not be a better product) pays $2,000 commission, can you trust my opinion? My spider sense is tingling, and so should be yours.

Others are “fee only” consultants which means you pay them an up-front fee for doing an analysis of your financial situation, and making recommendations - which funds to purchase or how to re-balance your portfolio. This is more a “do-it-yourself” approach as then you can purchase recommended mutual funds through an online broker (which isn’t that hard) or your bank. Personally, I’m more comfortable with this approach because one might argue the advice you get from an independent consultant isn’t affected by commission payments.

If I was to go back in time and start investing in mutual funds all over again, I would try to deal with “fee-only” consultants simply because of trust issues. It is my personal opinion (underline “personal opinion”) that when somebody gets paid a set fee, their recommendations will be less biased, and geared towards products that are better for me, not the ones that pay higher commission.

Word of advice: when investing your money in mutual funds, make sure you know how your broker or consultant is getting paid. While it might be an awkward question, you must know this and keep it in mind when making your purchasing decisions.

The fund management needs to get paid too

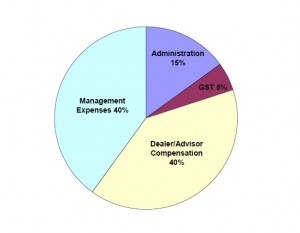

All actively managed mutual funds charge for their services. After all, people who make buying and selling decisions around the fund can’t do it for free. They also need offices, marketing budgets, and fancy coffee for visitors. In most cases, mutual funds pay a percentage of their assets to a management team and that amount is called MER (management expense ratio). You can find the percentage paid to management in the prospectus document given to you (or find it online). Here’s a typical breakdown of management fees:

Investing in mutual funds

You have to be aware of the MER charges when investing your money in mutual funds because they do affect your returns. After all, if your fund gained 10% last year, your actual return would only be (10% - expense %). Some funds have higher expenses, some have lower ones. For example, index mutual funds almost always have lower expense ratios which make them far more appealing than mutual funds pushed by big brokerage companies, sometimes as high as 2.7%. You might not think this is a huge amount, but over the long period of time even 1% difference in MER charges makes a huge difference on your overall portfolio. If you feel like playing around with numbers, check out this calculator to get an idea how MERs can affect your portfolio performance.

Also, keep in mind that fund’s management team gets paid either way. Whether your fund loses money or makes money, the MER amount is being taken out of the mutual fund and transferred to mutual fund management team. While some people might say that actively managed mutual funds deliver better results and thus make up for higher expenses, a number of studies find that only a minority of mutual funds beat the market.

Personally, I wasn’t aware of management expense ratios when I was taking my first steps into investing world. To me all funds sounded the same, and the only number that mattered was their performance. If I was to start investing in mutual funds all over again, I would stay away from funds that charge high MER and instead look into cheaper index funds or ETF funds.

Word of advice: when investing your money in mutual funds, be aware of management expense ratios (MER), look for them in prospectus documents, ask your broker about them, and keep them in mind when choosing between funds.

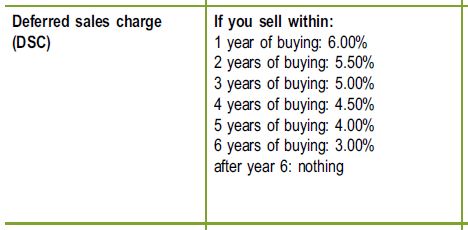

Some funds have deferred sales charges (DSC)

Most mutual funds have sales charges associated with them. Sometimes they’re charged right away and taken out of your investment thus reducing your buying power (these funds are known as front-loaded). Others charge you a sales charge when you decide to sell (back-loaded) and the amount is prorated to the length of time you’ve been holding your investments in this particular mutual fund. Believe it or not, there are also no-load mutual funds that don’t charge sales charges when you sell them.

Here’s a typical deferred sales charge (DSC) schedule for an actively-managed mutual fund (keep in mind that numbers might differ from fund to fund):

Investing in Mutual Funds

What does it mean to you? This means that if buy $10,000 worth of back-loaded mutual fund and decided to sell it the next day, you will get charged 6% of your investment. Most of this sales charge pays for the commission the mutual fund paid out to your broker when you put the transaction through.

Now, is this a big deal? If your investment horizon is several decades and you’re in for a long haul, the deferred sales charge might not be a big deal to you. But if you’re just starting investing in mutual funds and you’re not sure how long you want to hold this particular fund, you might want to go with no-load funds. In my case, I had to pay deferred sales charges when I’ve decided to change my investment strategy and ended up selling my mutual funds.

Word of advice: before you complete the transaction, make sure you’re aware of any DSC charges attached to funds you’re purchasing. Ask your broker - are these funds back-load, front-load, or no load at all? If your investment horizon is short, you might want to look into purchasing no-load mutual funds.

p

Net Worth Update - End of 2013

Net Worth Update - End of 2013

Net Worth Update - 2013

Following the example of a number of personal finance bloggers, I’d like to start tracking and updating our net worth on a regular basis. Tracking it monthly doesn’t quite make sense to me (translation - way too much work), so an annual checkup should work just fine.

The value of our house is based on the most recent assessment notice issued by BC govt - some people might disagree with this method of valuing a property, but in our case this will provide most consistent figures (unless I start putting up our home for sale every year just to see what is the real market value of it - and it is too much work as well).

I’m only including major items in our net worth calculations - no need to start including absolutely everything like value of our car (non-existent!), and my vast collection of unfinished sock puppets. No Picasso painting for us, and I’m not about to go through my wife’s jewelery box to make the calculations perfect. After all, I’m not trying to pad the numbers and impress anybody - it’s only meant to show our progression towards our goals.

Net Worth Update

Investment and cash accounts: $190,853.21

Cash and saving accounts: $23,707.68 (includes emergency fund, chequing account, and various saving accounts - new car, annual property taxes, etc.)

RRSP accounts: $2,675.58

Non-registered investment account: $108,005.95

Mr. Financial Underdog TFSA account : $28,719.00

Mrs. Financial Underdog TFSA account: $27,745.00

Other assets: $275,000

Principal residence: $275,000

Liabilities: $207,171.39

Principle residence mortgage: $207,171.39 (as of Dec. 31, 2013)

Total Net Worth (Assets - Liabilities): $258,681.82

Good news:

- If we sell all of investments and empty out bank accounts, technically we can almost pay off our mortgage and be completely 100% debt-free. But since investment returns are much higher than our mortgage rate, I think it would be counterproductive. But still kinda cool.

Bad news:

- A good chunk of our assets is tied up in our principal residence (sounds way fancier than “our home”, eh?). For the most part, these are fantasy money as there’s no easy way to get them out and invest. Tapping into home equity for the purpose of investing is technically possible by using Smith Maneuver (story courtesy of Million Dollar Journey which is a kick ass resource for anybody interested in personal finance), but at the moment I’m only exploring it as an option down the road.

- We don’t use RRSP accounts although have plenty of room available. I’m not worried about it as contribution room keeps growing, and we can always put some money into RRSPs later on.

- Our net worth is lower than I was hoping it to be (no surprise there). The formula I use is borrowed from Thomas J. Stanley’s book “Millionaire Next Door” :

Net Worth

I think this means we have some catching up to do! I will make another Net Worth Update some time next January to show the progress.

***

According to this article, just 85 people—the richest of the world’s rich—hold as much wealth as the poorest 3.5 billion. That’s half the world’s population. Amazing.

Canadian Banknotes are fascinating! - $10

Canadian Banknotes are fascinating! - $10

Previous story: Canadian Banknotes - $50

Canadian banknotes can be truly fascinating!

While going through my wallet, I found a new $10 banknote that is currently in circulation. The ten dollar bill (polymer series) once again features some of Canadian pride and one of the most prominent politicians in Canadian history.

Front Side - Sir John Alexander Macdonald:

Canadian Banknotes

Sir John Alexander Macdonald was the very first Canadian Prime Minister and served for a number of terms (1867–1873, 1878–1891). After his family immigrated to Canada from Scotland, he became a lawyer and shortly after got involved in politics slowly rising to the top of the political scene. His actions helped shape Canada as we know today.

Notable achievements and interesting facts:

- Dominion of Canada came to existence on July 1st, 1867. Same day, Sir John Alexander Macdonald was knighted (hence “Sir”) and appointed the Prime Minister of newly formed government.

- Shortly after, the very first general elections were held in Canada. Interestingly enough, back then no secret ballots were used and votes were made public.

- Under his rule, Trans Canadian Railway slowly came into existence and was completed after years of planning and design. The entire project was extremely expensive for such small nation, and required heavy borrowing, negotiations, and compromising. Few times the project almost went bankrupt - but it was finally completed on November 7th, 1885.

- Mount Macdonald at Rogers Pass, Ottawa Macdonald-Cartier International Airport, and Ontario Highway 401 (the Macdonald-Cartier Freeway) are all named after him.

- John Alexander Macdonald was known to be quite a drinker - to the point his drinking would sometimes get in the way of politics.

- John’s first wife Isabella Macdonald was John’s first cousin. Apparently cousin marriage was no big deal back in the day.

Famous quote of Sir John A. Macdonald (one of many):

“Let us be English or let us be French… but above all let us be Canadians.”

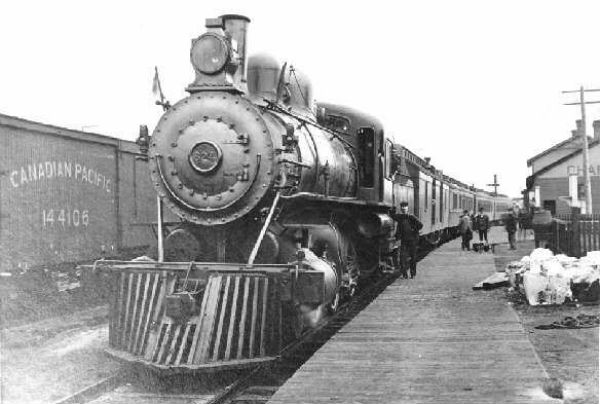

Back Side - The Canadian:

Canadian Banknotes

Back side of the bill features The Canadian train winding through Rockies as a tribute to Sir John Macdonald as the main driving force behind Trans Canadian Railway.

Interesting facts and information:

- British Columbia joined Canada in 1871 with the promise that it will be included in Trans Canadian railway project. People of BC were also given large sums of money as part of the deal to repay their debts.

- Overall cost of the project was estimated around $100,000,000 which was a monstrous amount of money in that time.

- The project caused First Nations rebellion in Manitoba against Canadian government which lasted 6 months but ended after Canadian troops were brought in.

- The railway was completed in on Nov. 7th, 1885 in Craigellachie, BC (area between Sicamous and Revelstoke). First train arrived at Port Moody from Montreal on July 4th, 1886.

- Port Moody was originally the final destination for the railway on the west coast. But by 1886, the Canadian Pacific Railway Company had decided to extend the line further to the West to Vancouver after local businessmen promised to fund the extension for their own benefit.

- Ride between Montreal and Port Moody was five days and nineteen hours long.

Canadian Banknotes