Recent Posts

I hate cash - and here is why...July 14th, 2014

I Hate Cash I hate paper bills in my pockets (even though new Canadian bills are now actu[...]

Seven budgeting myths I will bust for you (number 2 is my favorite!)July 1st, 2014

Budgeting myths need to be busted Here's the thing about exercise. Nobody really wants to[...]

Best Savings Account - Tangerine vs. President's Choice. The Ultimate Showdown!June 23rd, 2014

Best Savings Account -President's Choice Financial or Tangerine? When it co[...]

Book giveaway! David Bach - Smart Couples Finish RichJune 16th, 2014

Hey, who doesn't like free stuff? I'm giving away a copy of David Bach's Smart Couple[...]

Why do immigrants save more money?June 9th, 2014

Did you know that Canadian immigrants save more money? WARNING: This article is full of s[...]

Mid-year update: Goals and Resolutions – 2014June 2nd, 2014

Goals an resolutions strike back! Holy macaroni, does the time fly or what!? Feels like o[...]

Dear Debt ... it's been a whileMay 23rd, 2014

Dear Debt, It's been a while since we've talked. Five years ago I've walked out on you. F[...]

Recent Comments

Financial Underdog { You know what, this is a great tip - I should take all the change I've collected over the years and just dump it into... } – Jul 15, 8:34 AM

Financial Underdog { You know what, this is a great tip - I should take all the change I've collected over the years and just dump it into... } – Jul 15, 8:34 AM Alicia @ Financial Diffraction { I have done that too. I guess I don't have quite the aversion to it because I carry a wallet that has a change purse.... } – Jul 15, 6:31 AM

Alicia @ Financial Diffraction { I have done that too. I guess I don't have quite the aversion to it because I carry a wallet that has a change purse.... } – Jul 15, 6:31 AM N { Thanks for your reply, Financial Underdog. I'm opening my PC Financial account tomorrow, and maybe also my Tangerine. I think I'll try the setup you... } – Jul 14, 8:50 PM

N { Thanks for your reply, Financial Underdog. I'm opening my PC Financial account tomorrow, and maybe also my Tangerine. I think I'll try the setup you... } – Jul 14, 8:50 PM Financial Underdog { Well, here's a real world example. I actually tried the so-called "envelope system" and it just pissed me off to no end. You're supposed to... } – Jul 14, 7:56 PM

Financial Underdog { Well, here's a real world example. I actually tried the so-called "envelope system" and it just pissed me off to no end. You're supposed to... } – Jul 14, 7:56 PM Alicia @ Financial Diffraction { See, I find cash more tangible than plastic. Maybe I'm just not as evolved as you, but I need the concrete feel of money going... } – Jul 14, 7:31 AM

Alicia @ Financial Diffraction { See, I find cash more tangible than plastic. Maybe I'm just not as evolved as you, but I need the concrete feel of money going... } – Jul 14, 7:31 AM Financial Underdog { Hey N, Thank you for your thoughts. Like I've mentioned in one of my comments, I actually have both. ING/Tangerine is my savings powerhouse with... } – Jul 13, 10:00 PM

Financial Underdog { Hey N, Thank you for your thoughts. Like I've mentioned in one of my comments, I actually have both. ING/Tangerine is my savings powerhouse with... } – Jul 13, 10:00 PM

Yearly Archives: 2013

Rising Mortgage Rates in Canada - What happens if the rates double?

Rising Mortgage Rates in Canada - What happens if the rates double?

Rising mortgage rates in Canada?

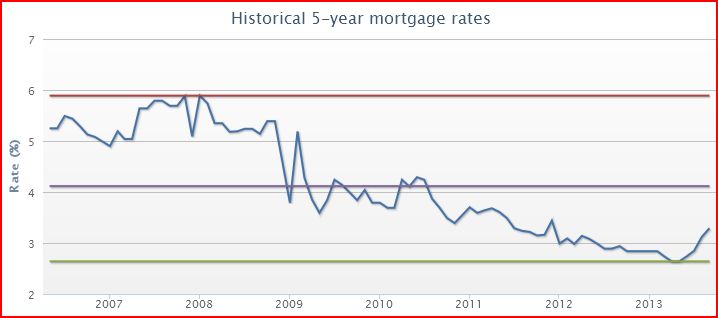

Rising mortgage rates in have been discussed for quite some time. As you may or may not know, mortgage rates in Canada are tied to Bank of Canada lending rate - banks borrow their money from Bank of Canada, and then turn around and lend money to you and me. Of course, they charge a bit extra - after all, they’re in business of making money, not simply passing it around. Once you understand this, it’s easy to understand that Bank of Canada lending rate is tied to mortgage rates in general. If Bank of Canada brings their rate up, almost all banks follow the trend and raise their rates - because they don’t want to lose money. Three days ago, Bank of Canada made an announcement that interest rates will be staying where they’re now for now.

But it’s important to understand that currently mortgage rates (and other lending rates) are at historical lows. If you ever talk to old-timers, they’ll remember the rates being in double digits - 15-20%. Rates have been falling over the years - and with last recession Bank of Canada cut them to never-seen-before levels. Where will they go from here? I think it’s safe to say that they have nowhere to go but up. The economy is coming around, and sooner or later our government will have to do something to prevent it from running away again - and interest rates is one of the ways control it.

What are you paying now in interest?

If you ask somebody about their mortgage rates, they’ll probably respond “Oh, I’m paying around 3% currently”. People who pay a bit more attention to their finances will say “My monthly mortgage payment is $1200″. Somebody who is borderline obsessed with personal finance (that would be me) will say “My by-weekly mortgage payment is $495.17, and I pay my bank 3.89%!”.

Your mortgage payment consists of two parts - principal repayment (amount that goes towards paying off the house) and interest payment (amount the bank gets for lending you money). Lumped together is the amount leaving your bank account every month (or by-weekly if you’re on by-weekly payments). If you ever want to get depressed quickly, ask your bank how much of that amount is interest and how much goes towards the principal. Just because I had nothing to do, I called my bank:

$157.99 Principal Payment + $337.17 Interest Payment = $498.16 Mortgage Payment (by-weekly)

Good god, somebody give me some wine. My mortgage payment is mostly interest charges! No wonder banks have such nice buildings.

What happens if the mortgage rates double?

Currently we’re paying 3.89% on our mortgage - which was a good rate when we bought our little home, not so good right now. Historical average for mortgage rates over the last 30-40 years is actually closer to 8 percent, or roughly double what it is right now for us personally. In two years, we’ll have to refinance our mortgage since our 5-year term will be up - but what kind of rate will we get? And with all the talk about rising mortgage rates in Canada - I got curious and decided to do some math.

Quick and dirty math on our mortgage payment if our rates double. The real number would be slightly off - because by that time our mortgage amount would be lower but that’s why I call it quick and dirty:

$157.99 Principal Payment + $674.34 Interest Payment = $832.33 Mortgage Payment (by-weekly)

Good god, I need more wine. If the interest rates indeed double in two years, our mortgage payment will be over $800 (by-weekly) - which means we’ll be paying over $1600/month.

Can we afford it? Well, it will certainly put a break on our saving rates - currently we’re saving quite a bit for the future as many financial advisors recommend. If the mortgage rates double (and I doubt our income will do the same thing unless I start removing my clothes for money), most of the increase will have to come from the money we’re currently saving. The result? Less money being saved for the future, less money for consumption, and a whole lot of wine being bought.

How will rising mortgage rates affect you personally?

Ask yourself few questions - what is your current mortgage rate? How much are you paying in interest and principal payments? What happens if mortgage rates return to their historical average, will you be able to afford your house? Will you have to adjust your life?

While many people might be scared of rising mortgage rates in Canada, one thing you can do to punch fear in the face is to educate yourself. At least once you know your situation and facts, you can make an educated decision to worry about them - or not.

Once you educate yourself, you can look at some options - refinancing your mortgage to lock into current rates or even extending your mortgage term to 10 years. You can also increase your current principal payment and accelerate your mortgage repayment - this way your principal amount is lower when you’re refinancing.

Resisting The Urge To Buy - My Way Of Saying “NO!” To Myself

Resisting The Urge To Buy - My Way Of Saying “NO!” To Myself

Resisting The Urge To Buy

Saying no to yourself can be hard. We’ve all been there - here’s this new thing we have in our mind. It’s shiny, new, and it’s absolutely awesome. It has all the latest bells and whistles. It’s high definition and it grills better burgers. It has better gas mileage and better upholstery. And it’s on sale! Whatever that is - I want it. Good god, I want it now, and I deserve it!

But I also know I can’t go around buying stuff. Between paying for everyday expenses such as mortgage, groceries, gas and bills, saving for larger purchases, and investing for the future, money tends to run out fairly quickly. If I acted on every single urge that comes in, I’d be out of money (unless I bought a money tree, but I haven’t seen one for sale).

Why is it so hard for me sometimes?

What makes things especially hard for me is that I get excited about new things very easily. My mind quickly jumps into rationalization mode and shows me 17 ways this new thing will make life awesome for me. If it’s a new barbecue, I can almost smell the freshly grilled meat and hear the noise of a party in the background. If it’s a car, the brain paints me the picture of long road trips in a shiny new car. If it’s a gadget - all the ways this new gadget will make me more productive.

People (and myself especially) are masters of rationalization. We can turn a “want” into “need” with a lightning speed. My mind almost whispers into my ear how I deserve this new thing - and why I should have it. ” - Come on, you’ve been working hard. It’s time to treat yourself a bit. You deserve it!”.

Grills quickly become investments into relaxation that we so badly need. New SUV - investment into safety (even though SUVs tend to be less safe to begin with). New iPhone - an investment into productivity (although the other iPhone was just as fine when it comes to Angry Birds).

My “magic” system to resisting the urge to buy!

Over the years, I’ve figured out the ways to drastically cut down on impulse buying - especially when it comes to larger purchases.

- Step 1: Think back to all the things I wanted to buy … and didn’t.

By now, I have a list of things I really wanted to buy but didn’t. Some of them look silly by now, some are quite reasonable but timing was wrong. Every time I get the urge to buy something, I look back to my experience, and think “Will it be like this time I wanted to buy … and didn’t? Will it look silly after a while as well?”

Chevrolet Camaro IROC-Z

For some reason, I really wanted to buy this car when I was much younger. I even looked at few for sale, but after a while my interest in it fizzled away. And thank goodness - the thing is butt ugly.

Honda Silverwing motorcycle

Just like anybody else, I went through “I want to ride a motorcycle” phase. I even saved up some money, and started looking around for used ones to buy. After a while, I found a decent Honda for sale, and met with the owner. The bike was in great shape, but I can’t say the same thing about the owner - he was using crutches. Apparently, he had a small accident on a motorcycle just few weeks ago that left him with broken legs, and that was the main reason for selling it. Let’s just say I lost interest in riding bikes on the spot.

Compaq iPaq handheld computer

This was a hard one. The technology nerd in me was going overdrive screaming I really really need this. All the features appealed to me. I imagined myself being super productive with it, scheduling events, and sending emails. After waiting for few weeks, I’ve discovered the fact I can send emails just as easily from my computer, and scheduling works just as fine with a small notebook if needed. I wonder if these things are still around? Looks rather archaic by now.

- Step 2: Save money in cash

I made a promise to myself to never ever buy anything on credit. Every single purchase I make is only done with cash - and cash is saved up no matter how long it takes. Sometimes it’s just couple of months, sometimes it takes much longer - but I always save money in cash. Credit sure makes purchases easier - these days you can even buy pets on credit - but credit also makes it easier to follow through on foolish decisions.

- Step 3: Think how this purchase fits into my plan

Ultimately, you always want to be somewhat utilitarian. Ask yourself - what benefit will you get from this new purchase? How will it benefit your life as a whole? If you have goals you’re working on - how this new purchase helps you achieve them? Some purchases truly benefit you and your family - a second car will allow your partner to bring in a second income or make your life easier. A new flat screen TV (slightly bigger than your other flat screen TV) on the other hand doesn’t carry any benefits because the other TV is just as good - just smaller. Is high definition really worth the money?

- Step 4: Revisit the idea once money is saved up

Once I have the money in hand, and I’m staring at the item I want, I revisit the idea of buying it one more time. Do I still want it? Does it still appeal to me? I’ve worked really hard to save up the money and can almost see the sweat dripping from it - do I really want this new thing?

Countless times, I’ve walked away from the deal at this point of buying. For various reasons, I just didn’t want to go through the process after all the time and effort I put into saving the money.

Short version - just be patient.

Whatever your system to resisting the urge to buy, it all comes down to patience. Each of us has a couple personalities inside of us - rational frugal personality and “Oh good god, I want it now!” personality. One wants to follow the plan, stick to a budget, and save money. The other one is looking for party and good times. The party personality wants to buy the world, the frugal personality wants to save money and do boring things with them (such as investments, saving for the future, etc.). The best way to fight the urge to buy is to insert time between the urge and actual buying - chances are by that time my party personality moves on to wanting something else. Saving money in cash allows the time to pass and some common sense to kick in.

Hope this helps you with resisting the urge to buy!

Best Personal Finance Podcasts

Best Personal Finance Podcasts

What are podcasts?

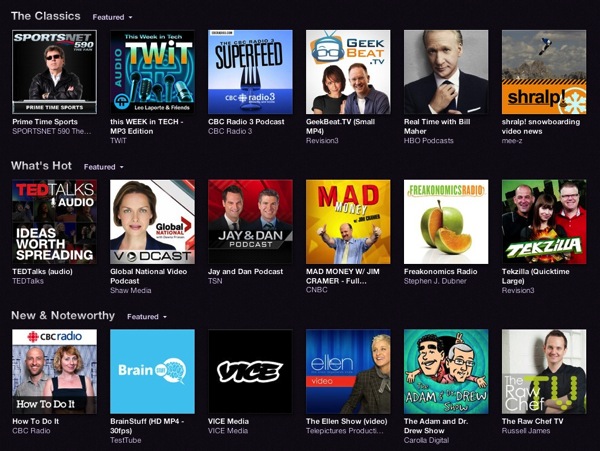

Well, before I talk about best personal finance podcasts, let me explain to you what podcasts are. Podcasts are digital radio and video shows that are available on your mobile devices completely free of charge. Unlike radio stations, they’re recorded offline, and uploaded for everyone’s enjoyment. Most mobile devices (iPhone/iPad, Blackberry, Android phones, etc.) have an app that allows you to search, subscribe, and listen to a podcast of your choosing. Think about them like your favorite TV show - once a new episode of Top Gear comes out (which happens to be one of my favorite shows), your iPhone downloads that new episode automatically and signals you it’s ready for your enjoyment. You can even listen to them on your laptop or PC, but I prefer a mobile device.

best personal finance podcasts

There is a mind boggling number of podcasts out there on different topics. Comedy, philosophy, business, education, etc. Basically, pick a topic, and there’s probably a podcast about it - even if it’s raising bunnies for food in captivity:) Most of them are audio-only, but there are some video podcasts as well. Just hit “Podcasts” app on your mobile device, and you’ll see thousands of them ready to be downloaded. My data plan on my phone is pretty pricey, so I always download all of my podcasts over WiFi. There are settings to manage that aspect on both Blackberry and iPhone.

Personally, I love podcasts. For some reason, it’s easier for me to listen to things as opposed to reading - that includes podcasts, talking to people on the phone, or listening to audio books. For that reason, podcasts are ideal for me. Listening to some of them became almost a ritual to me and a very good habit. Just one of the things I do to keep myself educated.

Why are podcasts so awesome?

First of them, they’re free. Second, they’re educational in nature. Third, they let you transform the time you’re wasting into time well-wasted. For example, one of my habits is washing the dishes and tidying up our living room at the end of the day. It’s almost like a ritual for me before winding down for the day. Instead of simply washing dishes, I listen to a podcast AND wash dishes. Keeps me from getting bored - and also keeps my wife happy as she hasn’t touched the dishes in years.

I also spend considerable time driving sometimes - nothing like having 3-4 hours of entertainment and education saved up for a long trip.

Best Personal Finance Podcasts

Following are some of my favorite podcasts on the subject of personal finance. Hosts of these podcasts are very educated individuals, podcasts are very educational in nature, and bring a lot of value to listeners. Best of all, they’re all free. Some of them have commercial spots, but they’re easy to ignore.

Motley Fool Money

Motley Fool Money is a great resource on investing. They cover major events in investing world, economy, and business news. Their weekly podcast comes out on Friday, and covers major events that took place that week. They also have an interview or two on different subjects, and some rather entertaining banter. After listening for a while, you start to understand how some of the publicly traded companies perform, learn to make educated guess about investments, and simply stay “in” on business news. Highly recommend!

They also publish Market Foolery podcast - this is a daily podcast about stock market events. If something major is happening on the stock market, they’re probably discussing it in these very short (10-15 minutes) daily podcasts.

Brian Preston’s “Money Guy”

Brian Preston runs a wealth management company somewhere in the south of US. Every other Friday, they put together a podcast about personal finance and investing. Unlike Motley Fool described above, they mostly cover topics of personal finance and investing from the point of view of average people. They put together podcasts full of useful information. Though their personal finance philosophy is a bit different from mine, I listen to these guys religiously. My only grumble about them - being from US, a lot of their information on taxes and investing is very US specific. But general advice and tips and tricks are absolutely fantastic. I consider it to be one of the best personal finance podcasts out there.

The Dave Ramsey Show

Dave Ramsey is an award-winning author of several books and a host of Dave Ramsey radio show with an enormous and cult-like following. Though not very known in Canada, his books are absolutely fantastic for somebody who is stuck when it comes to personal finance. Motivational value of his books alone is out of this world. His philosophy on money and personal finance is very old-fashioned, and very simple - yet very effective. His daily podcasts are about 40 minute long recordings of his daily radio show and features callers with specific questions and Dave’s advice on how to solve their money problems. Sometimes some of his rantings too!

He can be a bit controversial for some people, but overall it’s a great podcast to listen to keep yourself motivated while fighting through money problems. Nothing like listening to people scream “I’m debt free!!!” to keep yourself going!

NPR: Planet Money podcast

Planet Money is a part of non-profit media company (NPR). While their Planet Money podcast tends to focus more on economic events, it is highly educational if you want to learn more about currencies, political influence in the world of money, and just weird facts about money in general. They do a great deal of research for their episodes, sometimes flying into other countries to learn more. Some of the topics covered are money laundering (always wanted to learn about it!), alternative currencies such as bitcoin (fascinating!), and history of money (did you know United States had 8 thousands forms of currency before the American dollar was born?). If you ever want to educate yourself about money in general, this is one of the best personal finance podcasts.

Money Plan SOS!

Money Plan SOS is a podcast of Steve Steward, who is a personal finance coach. His weekly podcasts are more about an average person fighting for his money. He doesn’t touch much on business in general, more on things about how you personally can improve your personal finance well-being. While he closely follows Dave Ramsey’s teachings (being one of his approved coaches), Steve injects a lot of his personal thoughts into his teachings that make this podcast very valuable. Unlike other financial coaches, he shares his mistakes and struggling as well as successes - and it tends to be very personal.

Derek and Carrie’s Better Conversations on Money and Marriage (added July 15, 2014)

Why haven’t I discovered this podcast before? I’ve recently discovered this podcast and just had to add it to my list of best personal finance podcasts. It would make my life so much easier! In all honesty, it took way too much energy and time for me and my wife to work out the best way to deal with money as a family. Heck, I didn’t even know how to talk about money at the beginning. Many days were lost to heated discussions on how to spend money and how we can improve our financial situation. Thankfully, we were able to work out all the kinks without cutlery flying across our house, but there were a few close calls.

Derek and Carrie run a podcast with focus on how people relate to money in their marriages. They discuss topics of talking about money with your spouse, creating budgets, pros and cons of combining finances, and many other topics. If only I knew about this podcast sooner! If you want to improve your marriage and communicate better with your spouse on money topics, this podcast will be invaluable to you.

Listen, Money Matters! (added July 15, 2015)

Sometimes one can find the process of learning a bit tough if they can’t relate with the person presenting the information. For example, I’m a younger person (ok, younger’ish), and I can’t listen to a boring university lecture about compounding interest or mutual funds. In most cases, I’d like to learn from people just like me, who have same challenges, fears, and inspirations.

Well, Listen Money Matters podcast is right up my alley. Matt and Andrew speak about personal finance without holding anything back. They’re not university professors teaching economics, they’re your average everyday dudes who just happen to discuss personal finance and investing world. They speak my language and I can relate to them on many levels. Heck, they even discuss drinks they’re consuming at the moment!

If you’re looking for people you can relate with and learn some valuable lessons about money and investing, give Matt and Andrew’s podcast a try!

How do I start listening to podcasts?

best personal finance podcasts

Just hit Podcasts app on your iPhone or Blackberry. At this point, the app will let you browse the entire library of podcasts, or search for specific ones. I highly recommend you to check out these specific shows as I consider them the best personal finance podcasts. Hey, you have nothing to lose - all of them are free. Think of your car as a university on wheels - instead of just driving to work, might as well drive to work and educate yourself. Or wash dishes - whatever is it you’re doing can be used as a chance to educate yourself on personal finance.

Jolly good financial habits that can make you rich – Only reading won’t help

Jolly good financial habits that can make you rich – Only reading won’t help

Who do you actually think of when you hear the word “rich”? Evening gowns, traveling, yachts? Are these the only words that come to your mind? Well, that’s true to such an extent but not all rich people lead their lifestyles in such a way. “Rich” should be defined as a state having excess of money and there is a huge difference between ‘rich’ and ‘lavish’. Those who are self-made rich, are the different breed of people as they live differently and think differently. The financially wealthy are the ones who follow certain habits which should be incorporated by all those who wish to be rich but aren’t being able to get back on track. Although you might be able to find different financial blogs that will teach you ways in which you can become rich but do you think that only reading those financial tips will help you become rich? Certainly not! You require incorporating them in your day to day lifestyle. Here are some habits that the rich follow and those that the “wannabe-rich” should follow.

Build wealth by saving cash:

Yes, this might be hard to believe, but the rich people do save money. Rather than eating out, they keep tucking in their dollars into different financial assets that pay them in the near future. As per an opinion by Jean Chatzky, 60% of the self-made rich are there due to their high savings rate. Write down all those areas where you spend money where you don’t need to spend. Be honest and get serious to find out all those cheap alternatives. If you’re someone who loves to shop Starbucks every morning, stop there and change this habit. When you’ve built your fund, invest them in the financial assets and watch it grow with time.

Don’t pay your dollars for things that you don’t need:

You might see your neighbor spend a lavish lifestyle but don’t try to outdo them. Rather stay within your budget when it comes to spending for all those things like your car and house. Are you presently paying $400 for your SUV and do you think that it is simply drinking down your dollars? If answered yes, pare down and cut down your dollar expenses. Determine whether or not you really need an SUV? Could you move on with a mini-van? Would that be a cost-effective alternative? Take a close look at all those lavish upgrades that you have done to your home and then check where you need to cut back. While doing the assessment, if you’re not honest, then you’re simply wasting your time.

Set financial goals and try to achieve them:

Taking steps will be a lot more productive when you know what your financial goals are. The rich are always sure about what they earn and they’re always ready with their plan before they go out to take any step. They always research on the ways in which they can earn the money that they want and they keep setting goals around it. Set financial goals that you can easily achieve as the moment you obtain them, this will boost your confidence. Once you reach your goals, set new ones so that you can always look forward to a new horizon.

Believe in “simple living high thinking”:

Yes, you might not believe this but the truth is that the self-made rich are the ones who lead simple lives than most other people. They don’t have 100 pairs of shoes and they don’t strive to possess them as they know that they won’t require them. So, you should take a close look at your house and get rid of all those things that you don’t need. Think twice before spending your dollars and always go for the simple.

Therefore, only reading the personal finance tips to become rich and build wealth won’t help unless you incorporate them in your daily life. Follow the above mentioned tips and keep debts at bay. Although there’s enough of debt help options in the market, you should try to be safe than sorry.

Guest Posted by Trenton

/p

Best Bank for Saving Money

Best Bank for Saving Money

Why do you need more than one savings account?

We have a number of saving accounts. While some people are quite happy with having just one saving account, I like having a number of them for all our needs. To me, it just makes your saving goals clear and defined. You need to save some money for a new TV? Well, figure out how much money you need and make sure by certain date there’s that much money sitting in your “New TV fund” account - as opposed to lumping your savings into one account and not knowing what goals still need to be reached.

- Investment account or what I call “Paying Ourselves First” account. This is where we transfer a set percentage of our income to be later invested.

- Emergency fund. This is our rainy day fund - anytime we have an emergency, we have access to our own safety net as opposed to borrowing money or using credit cards. I already covered the importance of having an emergency fund a while ago. Last time our dryer broke down, the money came from our emergency fund without breaking the bank or monthly budget.

- Gifts. My wife is one of the kindest and giving women I’ve ever met. She loooooves giving presents - and she gives a lot of thought to presents. Her brain has a built in calendar for birthday dates of anybody we’ve ever met. I on the other hand have terrible memory and can never pick anything meaningful - partly because I’m a practical kind of a guy. To make sure gifts and presents never throw our budgets out of whack (how it used happen right before Christmas), we’ve came up with a monthly figure we contribute towards gifts. It accumulates there month after month, and my wife can spend it anytime she needs.

- New Car account. Our car is closing on 20 years by now - but it is in excellent shape and fairly low mileage of just over 200K. There’s not a single thing wrong with it, and for its age it looks absolutely fabulous. Honestly, it will be hard for me to say goodbye to our Donkey (that’s what we call it between me and my wife). But you never know what happens, and there might be a day when the engine completely gives or it gets stolen. Just in this case, we’ve been saving money for a new car - if the need for a new car arises. By now it’s almost fully funded, so we can just write a check and buy a new car - but for now we’re perfectly happy with our Donkey.

- Annual property taxes. We own our condo, and one of the pleasures home ownership comes with is the annual tax bill. Thankfully, our condo if quite affordable when it comes to taxes, and we just have to save around $90/month. Once a month we transfer $90 into this account, and come July pay our taxes. Easy, peasy, nice and breezy.

- Annual car insurance and condo insurance. These are pretty self-explanatory.

On top of it, sometimes I open accounts for small things we’re saving towards, for example a new couch or anything else we might want to buy that we have to save towards over few months.

What is the best bank for saving money?

Here’s how I define “the best bank for saving”:

- It has to be absolutely free. I haven’t paid any service fees in years, and would never pay for banking. No, even free banking in exchange for a min. balance won’t cut it - it has to be absolutely free!

- Funds have to be guaranteed by Canada Deposit Insurance Corporation (CDIC). If your bank goes bankrupt, CDIC will cover your funds up to $100,000.

- It has to be flexible. If we need to open an account, it has to be done quickly. Transferring money should be quick and painless.

- Money should be accessible at any time. Online, over the phone, or through an ATM.

Why I’ve chosen ING DIRECT?

I’ve been an ING DIRECT client for over 10 years by now, and I still consider them the best bank for saving money. I still remember their cheesy TV commercials when they first came to Canada - energetic fella telling us to “Save your money!” with a Dutch accent. It sounded so fresh and different from other banks, I had to check it out! Well, a mind-boggling interest amount paid out they’ve been proudly displaying online didn’t hurt.

1. ING Direct is absolutely free. No fees, no minimum balances.

2. ING Direct has an absolutely awesome mobile app to access your account along with online banking, phone banking, and access to ATMs. I’ve never had problems with getting a hold of customer service people, and their mobile web site is top notch. As a younger person, it is especially appealing to me - as transferring money on my iPhone sounds way easier than a trip to the bank branch.

3. ING Direct actually pays interest. While it’s not super high (1.35% last time I checked), it’s still higher than any “brick and mortar” bank such as RBC or CIBC.

4. You can deposit checks into your account (if you happen to have a checking account with ING) in your bedroom! By taking two pictures of a check with their app, you can deposit money straight into your account without the time-consuming trip to an ATM.

5. You can create as many accounts as you want. They all appear instantaneously online once you create them. Just as easy you can close them, move money between then, and set up savings goals. Every time me and my wife decide we have to start saving for something, we instantly open up an account and set up a monthly transfer goal.

On top of it, they also offer other products such as no-fee checking account (Thrive account), GIC’s, mutual funds, business accounts, and mortgage loans. On a side note, they happen to be the only bank in Canada that posts their real mortgage rates, as opposed to playing “bait and switch” game that other banks are famous for. I’m not familiar with their other products, so I’m not going to say much about them.

If you want to open a new account with ING…

It is surprisingly easy to open a new account - just go to their website, and have your SIN number ready. You’ll be surprised at how you lived without them after a while! And I know they’ve been bought out by HSBC recently, but personally I have no issues or worries about it. It’s a great business, and people who run it take a great pride in helping people save their money and reach their financial goals.

FREE MONEY???

Indeed! If you click on the link below, you can get $25 just for openning an account. If life gives you $25, say “Hey cool! Free money!”. In addition, instead of 1.35%, both of us will be getting 2.50%. Fabulous, eh?

I am Financial Underdog, and I highly recommend having multiple bank accounts for your savings!

Should I Be Saving Money If I Won’t Be Living Long Enough to Retire?

Should I Be Saving Money If I Won’t Be Living Long Enough to Retire?

What if I won’t be living long enough to retire?

On one of the forums I check out from time to time, somebody asked a question:

” - My brother-in-law puts very little thought into retirement savings. He has a tiny amount being funneled to a 401k and a small emergency fund. He isn’t a spendthrift, but isn’t interested in making a bigger effort. When I brought up my own plans, he told me he isn’t going to live long enough to retire.”

Is there a point to saving money then?

Well, here’s my personal opinion.

To me, saving money, improving your financial situation, and slowly building up your estate (portfolio, assets, whatever you want to call it) is not about living long enough to retire. The whole retirement thing as presented most of the time isn’t appealing to me at all - working hard all your life, saving up money, just to play golf all day and go on cruises once in a while? That’s just depressing if you ask me.

To me, having money is not about retirement. Heck, I don’t think I will ever retire. I think I will always work on something - if it’s not me working with my two hands, it might be an online business. If it’s not working on my own gig, it might be helping somebody with their company. Bottom line, the way retirement is portrayed most of the time is not something I am looking forward to, and it’s not why we’re working so hard on improving our finances.

What if I won’t be living long enough to retire?

Will everything I will do to that point be pointless? Of course not. If I do die early, my family won’t have to worry about money. My kids’ education will be taken care of so they can obtain their degrees. My wife won’t be forced to re-marry just because she can’t make it on her own - she will have enough money to make wise choices, not forced choice.

Having money will allow us take care of our parents and relatives - so we can always help them and not just find them a cheap retirement home where they won’t be treated right.

Having money is about freedom to do whatever you want to do - without worrying about your bi-weekly paycheck. There are things, I’m sure, you’ve always wanted to do but couldn’t because it would mean an end to your income. For example, I always wanted to cross Canada on a motorcycle. What if you didn’t have to worry about working 50 hours/week and bringing that paycheck? What if you could focus on your own personal interests for a while - money can make it possible.

Money is about helping others and sharing your wealth - and if you have plenty of money you can share it with a lot of people, and help a lot of people. You don’t have to retire to do that, and you can enjoy doing it way before that gray “near retirement” age.

And lastly, money is about being independent from circumstances. All of a sudden, you don’t have to worry about your car transmission. If it goes out, you just go ahead and fix it - or buy a new car altogether. You don’t have to put up with bad treatment at work - cause you can’t quit anytime, and take your time finding a better place to work for yourself.

None of these things have anything to do with living long enough to retire. And it’s not about being able to buy luxury cars or other “toys”. All of them mean comfort to your family, being able to take care of them, and just enjoying your life in general. Even if you don’t live long enough to retire in a traditional sense, money can greatly benefit your life. And that’s why I focus on working hard, managing money wisely, and investing for the future.

Have you ever asked yourself what money means to you?

Debt Pushers - They’re not your friends, they’re making money off of you

Debt Pushers - They’re not your friends, they’re making money off of you

Just a little episode with debt pushers

We have a credit card account. Yes, despite all the talk about how bad they are for your personal finance, I do have one credit card. We mostly use it for online purchases (because debit credit cards are not very common in Canada yet as opposed to US) and paying monthly fees at YMCA. So, the balance always gets paid off, we never pay interest, and overall are more than responsible with it.

It just so happens that I had to put a business expense on my Visa. Now, usually it’s a fairly simple transaction - I put it in, and before paying the Visa bill, I cut myself a check for the expense amount, and deposit the check into my account. This way I don’t end up paying any interest or fees, business ultimately pays for the expense, and there’s enough paper trail for bookkeeping to be fairly simple. No big whoop. Now, this time around, the business expense was rather large. While usually our Visa bill is around $150 or so, the business expense sent it way over $3,000. Still, no big deal because I’ll just cut myself a check and pay it without any delays.

But what do I get in the mail along with my Visa bill?

” Dear Mr. Financial Underdog,

We are writing to you about your credit account and pleased to advise you that because you effectively managed your account, we would like to offer you a credit card increase. “

Nicely done, debt pushers. I can almost see your software ref flagging my account. ” - Hey, this guy usually spends only this amount on average, but this time around he went into stratosphere! Hey, may be he needs more credit? May be he’s in trouble and now paying his bills with his credit card, I wonder how much more business we can get from him? If we’re lucky, he lost his job, and we’ll hook him up with all the product he needs, just need to make it easier for him to access it. Let’s give him all he wants right now!”

Debt pushers are just like street gangs dealing drugs

There isn’t much difference between drug dealers and debt pushers. Same approach. A troubled customer is the best customer! Just a different product. And I especially like the part how they complimented me on effective management of my account! When people start putting on huge amounts on credit cards - that’s not effective. Sure, my case is an anomaly, but in most cases it means people are out of control with their credit cards - and those are the best customers for banks, credit cards, and other debt pushers.

I’m not trying to say that banks are bad and credit cards companies are evil. They do what they do, and have a place in our economy. But at all times, you have to understand why they are doing what they’re doing. An increase in spending limit on your Visa benefits them, not you. Beware of snakes when you’re playing outside. Beware of gangs pushing their products on troubled customers - even if this product happens to be debt.

Secrets To Financial Fitness - Some similarities between financial and physical fitness and what we can learn from them!

Secrets To Financial Fitness - Some similarities between financial and physical fitness and what we can learn from them!

A little intro to secrets to financial fitness…

Secrets to financial fitness - do they exist? Is there a set of things you can do that will turn you into a wealthy individual over a short period of time? Ever thought there might be one little thing you’re missing that will help you achieve financial independence?

I’d like to draw a parallel between personal and financial fitness. Once I’ve started thinking about it, I was shocked how similar these two areas are - and how similar are the struggles people face in each area. Ironically, I used to struggle greatly in both, but currently working really hard on improving these two areas of my life. Just like I used to live paycheck to paycheck and owed more money than I actually had - I’ve struggled physically by being out of shape, and almost having a heart attack when climbing stairs.

Eight months ago (33 years old and 55 lbs. overweight), I signed up for a gym membership. I walked into a gym and felt completely lost. I didn’t know what to do, I was afraid people will laugh at me if I ask them for help, and I wasn’t sure where to begin. But little by little, I’ve made some progress. I’m far from being in the shape of my dreams (if there’s such a thing), but I’m proud of the progress I’ve made so far.

Here’s some of my discoveries when it comes to secrets to personal fitness - and how they relate to secrets to financial fitness.

Nothing happens overnight - and there is no silver bullet

Despite what late-night commercials will tell you, you can never get into great shape by working out 8 minutes per day. In fact, it’s scientifically impossible! Getting into shape requires hard work, and constant improvements in your workout routine, diet, and lifestyle in general.

What about financial fitness? Same thing applies! You can’t just do one little thing and turn your paycheck-to-paycheck lifestyle into a life of luxury and prosperity. There’s no software program that will show you all the secrets stocks about to double - if there was one, nobody would be selling it. While I greatly respect Robert Kiyosaki, I’m very leery of his personal finance lessons. You can’t become a Ferrari-driving real estate tycoon after reading a couple of his books. It might be possible, but don’t read his books think you’ll implement his system and be on the way to riches in a matter of months. Won’t happen.

Simplicity makes great sense

When I need a good laugh, I pick up a magazine on personal fitness and read a couple of articles. Good god, how many workout programs are out there - and why are they so different? It seems to me that every single fitness writer came up with his own program. In reality, all these programs and approaches do nothing but confuse new members. But if you talk to an experienced coach or trainer, they’ll tell you right away - most of the results can be achieved by doing a number of exercises over and over, again and again. Here’s a barbell, you can squat with it, you can bench press it, you can dead lift it. Do eight or ten exercises for 12-24 months, do them repeatedly and really well, and you’ll be in great shape. Maybe then it will make sense to target some obscure muscle by doing an exotic exercise, but most people shouldn’t be thinking about it.

Financially, it’s exactly the same. Yes, there are some tricks and creative accounting techniques - The Smith Maneuver, flow-through shares investments, etc. But for most average people most of the results will come from a set of simple rules that need to be followed day after day to achieve great results - and they are very simple too. Live on less than you make, invest part of your paycheck wisely, don’t spend money on stupid things, and keep track of your spendings. Yes, it’s hard to do it, especially in the beginning. But it ain’t complicated.

Pay attention to yourself, not the guy next to you

Want to completely confuse yourself about working out? Start paying attention to what other people doing more than to what you’re doing. I had to force myself to stop trying following other people at the gym (figuratively speaking). You see a guy slightly smaller than you bench press 180 lbs. and you automatically think - “- Oh, I should be able to do it no problem.” Wrong. What you don’t know is that he might have been doing this for months. Start with what you’re comfortable with, and go from there. Trying to chase other people will only cause you pain (emotional and physical).

On the personal finance side, chasing other people will get you in trouble too. Ever heard of “keeping up with the Joneses?”. It’s not productive to say the least. You don’t know financial situation of everybody, and looks can be very deceiving. Just because your neighbors or friends have nice luxury cars and big houses, doesn’t mean you should follow suite - they might be actually be able to afford those things or they’re deeply in debt. The only thing matters to you is your financial health, not your neighbors’. Don’t pay attention to them, follow your financial plan.

Start small

Things won’t turn around overnight, so there’s no need to go “all in” when you step into the gym for the very first time. You won’t be Mr. Universe (rather ironic title considering there’s only one planet involved) after a month of exercising, so start small. Start going once or twice a week - no need to promise yourself a rigorous 5 days/week schedule. No need to go on a “fruit-only” diet for a month hoping to shock your system into submission - just add an apple or a salad to your normal way of eating and go from there.

When it comes to your money, secrets to financial fitness are just as simple as personal fitness. Start small - try to pay off some of your debts to see how awesome it feels to be less in debt. Instead of promising yourself to eat nothing but cheese and crackers and invest 50% of your paycheck to retire early - try doing 2 or 5% first! Once you work out an appetite for financial fitness - then increase your workload.

Beware of the industry

When you start paying attention to your health, you’ll notice how huge the industry of personal fitness is. There are magazines, TV channels, countless websites, and late-night infomercials that are designed to do nothing but take money from you. I love Chuck Norris movies, but after going to a gym for a few months, I’m quite sure that Total Gym endorsed by him (along with other products) is total garbage. There are countless products appear out of thin air every year that are targeting novice gym members - or more like targeting their wallets.

On the financial fitness side things are just the same the same - there is a huge industry and everybody is trying to sell you a product. Educational classes, exotic types of insurance, personal finance software, and personal finance books - all whispering in your ear that these are essential products and you can’t live without them. Some are excellent products, and some are total garbage. You have to be aware of the fact that there’s a small army of salesmen out there trying to sell you something - and this industry is very good at marketing their products. Be aware and beware.

And the most important “secret”:

Never ever ever ever give up.

My name is Financial Underdog, and I’m currently rewarding myself with a nice smoothie for a very exhausting visit to a gym.

Happy Friday!

Happy Friday!

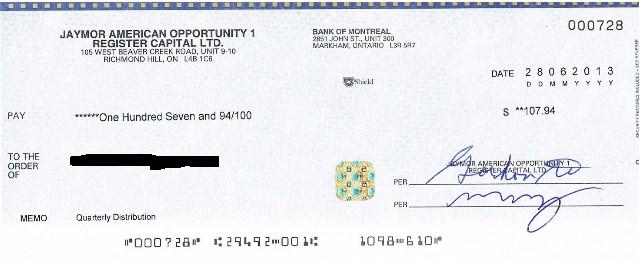

Somethings good things just happen. Sometimes you tell yourself : “- I can do anything!”. Sometimes you kick ass all day at work, and grab some tasty beer on the way home. And sometimes, when you get home you check your mail and pull out an unexpected check!

We made an investment in this company just couple of months ago - they acquire and operate apartment buildings in United States. On top of capital appreciation (prices of apartment buildings going up), they send out quarterly dividends. Not much, but I’ll take it!

It feels great to have money working for you - as opposed to working for money. While I have no problems with work - in fact, I’ll be working this weekend because it’s been so dang busy - but to have money produce money without moving a finger? That’s like free money!

Happy Friday! I’m The Financial Underdog, and I like unexpected surprises!

Investing in Canadian Farmland

Investing in Canadian Farmland

One of my core believes when it comes to money, is that you have to invest your money and make it work for you. I don’t want to work for money for the rest of my days - at some point, I’d like to get the money working for me so I can relax a little. Wouldn’t it be great to only work if I want to? To have a pile of money in different investments that produce a healthy return?

This is one of the reasons why several years ago we’ve decided to set money aside and actively invest them. Before that, we would just save money in savings accounts - but at some point it started to look a bit like hoarding - sure it was nice to have it, but with whopping 1-2% returns on our savings, we were basically breaking even after inflation. We could put money into stocks and mutual funds, but I’ve personally had bad experience with mutual funds before (more on that later), so we started looking into alternative investing options. Some interesting opportunities were discovered - one of them was investing in Canadian farmland (mainly Saskatchewan).

Why would anybody think of investing in Canadian farmland?

Well, there are several reasons for it:

- Investing in farmland provides an excellent security - it will never go to zero. Stocks can go to zero. Banks can go bankrupt. But farmland will always be worth something, it’s a real hard asset, and the value will always be there.

- Supply of farmland is decreasing which puts an upward pressure on its prices. For example, Wisconsin lost almost 500,000 acres of farmland between 1997 and 2002.

- It is fundamental to life. We need farmland to survive because food comes from farming. Other investments - for example gold or silver - might sounds like solid investments, but at the end of the day you can survive without them just fine - but try surviving without food!

- Investing in Canadian farmland represents stable, income producing assets that are going up in value and serve as an excellent hedge against inflation. Average annual return to owners of Saskatchewan farmland is around 10% (1972–2003).

What is farmland worth?

Farmland values have been steadily going up across Canada and US. Recently, in Canada they’ve reached new record highs. The main reason for it is diminishing supply and increased pressure on production. In other words - people need more food, but no new farmland is being made. In some areas, the prices per acre doubled in less than 3 years!

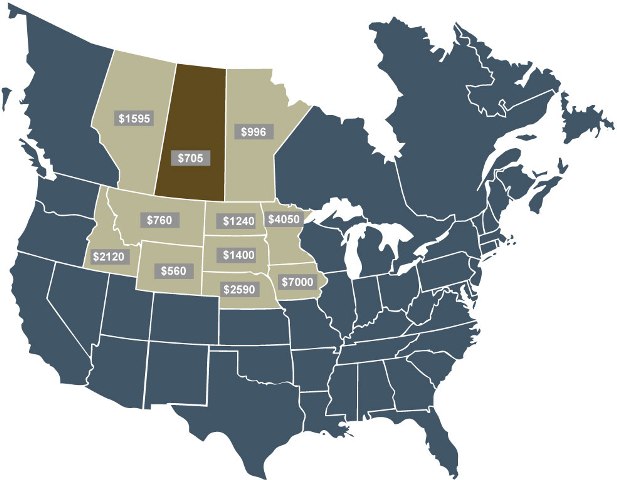

Here’s a picture of farmland values per acre in various states and provinces:

As you see, farmland prices in Saskatchewan are still low comparing to other provinces and various states - but they’re going up in value rapidly. In 2012, farmland prices in Saskatchewan went up by almost 20%.

How does one invest in farmland?

It comes down to basically two ways:

- Buying physical farm and leasing it out to a local farmer who will pay you a rent payment out of his business. One blogger that I read on regular basis did exactly that! He bought a farm (on credit which I can never understand, but hey…), leased it out to a farmer, and now receives monthly payments. It was very interesting to follow his adventure - from scoping out the location, to putting down the deposit, and to finally getting his first check in the mail. But while it is certainly exciting, this approach is very hands on, and you basically have to score a direct hit - buy an excellent farm, find a reliable farmer, and pray nothing bad happens. It reminds me of absentee landlording and how tough it can be.

- You can buy into a private investment fund that specializes in investing in Canadian farmland. That’s exactly what we’ve done a while ago. AgCapita is a Calgary-based investment company that raised $30M and bought 45,000 acres across Saskatchewan. We’ve limited our investment to $15,000 for now, but looking into buying more shares sometime this year. To be honest, I like this approach better - while it’s certainly doesn’t have the same excitement as owning a physical farm, I can sleep well at night knowing that a team of professionals who know everything about investing in Canadian farmland work hard for me by investing my money - they buy good properties, rent them out, and make sure returns are there. Their portfolio is worth close to $50M by now and annual compound returns reached 20% last year!

Some interesting facts about farmland:

- Saskatchewan contains almost 40 per cent of the farmland in Canada, close to 64M acres.

- Saskatchewan farmland is of the highest quality with great access to water, and with warming climate its productivity is expected to rise even further.

- Saskatchewan farmland prices were held down artificially until recently with restrictive laws - and now they have a lot of catching-up to do to reach other provinces.

I’m Financial Underdog, and I could never be a farmer. Something about waking up at 4 am just doesn’t appeal to me…